Environmental Awareness

Growing environmental awareness among South Korean citizens is significantly influencing the micro mobility market. As concerns about air pollution and carbon emissions rise, individuals are increasingly seeking eco-friendly transportation alternatives. The micro mobility market is positioned to capitalize on this shift, as electric scooters and bikes produce zero emissions during operation. Recent surveys indicate that over 70 % of South Koreans express a preference for sustainable transport options. This heightened awareness is prompting both consumers and businesses to invest in micro mobility solutions, which are perceived as a cleaner alternative to traditional vehicles. Consequently, the micro mobility market is likely to expand as more individuals prioritize environmentally responsible choices in their daily commutes.

Technological Advancements

Technological advancements are playing a crucial role in shaping the micro mobility market in South Korea. Innovations in battery technology, GPS tracking, and mobile applications enhance the user experience and operational efficiency of micro mobility vehicles. For instance, improvements in battery life allow e-scooters and e-bikes to cover longer distances, making them more appealing to consumers. The micro mobility market is witnessing a surge in the adoption of smart technologies, with an estimated 40 % of users utilizing mobile apps for locating and renting vehicles. This integration of technology not only streamlines the rental process but also provides valuable data for operators to optimize fleet management. As technology continues to evolve, the micro mobility market is expected to grow, driven by enhanced user engagement and operational capabilities.

Urban Congestion Mitigation

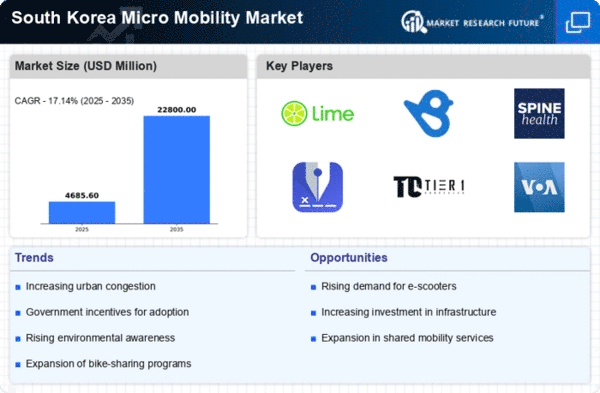

The micro mobility market in South Korea appears to be driven by the increasing urban congestion in major cities. As populations grow and urban areas become more densely populated, traditional transportation methods struggle to accommodate the rising demand. Micro mobility solutions, such as e-scooters and e-bikes, offer a practical alternative for short-distance travel, potentially reducing traffic congestion. According to recent data, urban areas in South Korea experience traffic delays averaging 30 % during peak hours. This situation encourages the adoption of micro mobility options, as they provide a more efficient means of navigating congested streets. The micro mobility market is likely to benefit from this trend, as consumers seek faster and more convenient transportation methods to avoid the frustrations of urban traffic.

Changing Consumer Preferences

Changing consumer preferences are significantly impacting the micro mobility market in South Korea. As lifestyles evolve, individuals are increasingly seeking flexible and convenient transportation options that align with their daily routines. The micro mobility market is responding to this demand by offering a variety of vehicles that cater to diverse consumer needs. Recent studies indicate that approximately 60 % of urban residents prefer using micro mobility solutions for short trips, highlighting a shift away from traditional modes of transport. This trend is further fueled by the rise of the sharing economy, where users favor access over ownership. As consumer preferences continue to shift, the micro mobility market is poised for growth, driven by the demand for adaptable and user-friendly transportation solutions.

Government Support and Regulation

Government support and regulation are pivotal in shaping the micro mobility market in South Korea. Authorities are increasingly recognizing the potential of micro mobility solutions to alleviate urban transportation challenges. Recent initiatives include the establishment of dedicated lanes for e-scooters and e-bikes, as well as regulatory frameworks that promote safe usage. The micro mobility market is likely to benefit from these supportive measures, as they create a conducive environment for operators and users alike. Furthermore, government incentives aimed at promoting electric vehicles may extend to micro mobility options, potentially increasing adoption rates. As regulatory frameworks evolve, the micro mobility market is expected to expand, driven by enhanced safety and accessibility for users.