Increased Healthcare Expenditure

The rise in healthcare expenditure in France is a crucial factor driving the orthopedic devices market. With the French government prioritizing healthcare funding, there has been a notable increase in the budget allocated for medical devices, including orthopedic solutions. In recent years, healthcare spending has risen by approximately 3% annually, reflecting a commitment to improving patient care. This financial support enables hospitals and clinics to invest in advanced orthopedic devices, thereby enhancing treatment options for patients. As the healthcare system continues to evolve, the orthopedic devices market is expected to benefit from increased accessibility and affordability of innovative solutions, ultimately leading to improved patient outcomes.

Expansion of Distribution Channels

The expansion of distribution channels for orthopedic devices in France is facilitating market growth. With the rise of e-commerce and online platforms, patients and healthcare providers have greater access to a wide range of orthopedic solutions. This shift in distribution is making it easier for consumers to obtain necessary devices, thereby increasing overall market penetration. Furthermore, partnerships between manufacturers and distributors are enhancing the availability of innovative orthopedic products across various regions. As the orthopedic devices market continues to evolve, the diversification of distribution channels is expected to play a pivotal role in meeting the growing demand for orthopedic solutions in France.

Rising Incidence of Orthopedic Disorders

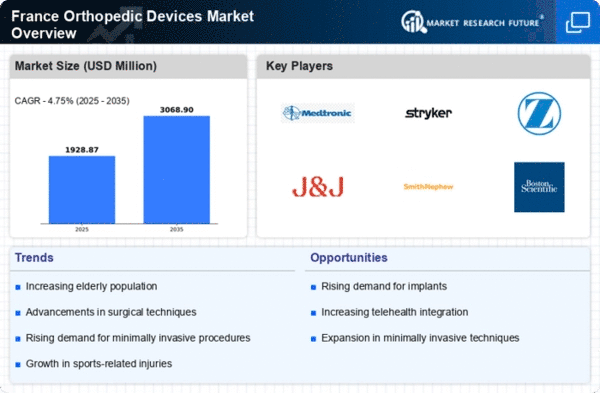

The increasing prevalence of orthopedic disorders in France is a primary driver for the orthopedic devices market. Conditions such as osteoarthritis and osteoporosis are becoming more common, particularly among the aging population. According to recent health statistics, approximately 20% of the French population suffers from some form of musculoskeletal disorder. This trend necessitates the development and adoption of advanced orthopedic devices, including joint replacements and spinal implants. The orthopedic devices market is projected to grow at a CAGR of around 5% from 2024 to 2029, driven by the demand for innovative solutions to manage these conditions effectively. As healthcare providers seek to improve patient outcomes, the focus on high-quality orthopedic devices is likely to intensify, further propelling market growth.

Growing Awareness of Preventive Healthcare

There is a growing awareness of preventive healthcare among the French population, which is positively impacting the orthopedic devices market. As individuals become more informed about the importance of maintaining musculoskeletal health, there is an increased demand for preventive measures, including orthopedic devices. This trend is evident in the rising popularity of orthopedic braces and supports, which are used to prevent injuries and manage existing conditions. The orthopedic devices market is likely to expand as more consumers seek out products that promote joint health and mobility. Additionally, healthcare providers are increasingly recommending preventive orthopedic devices as part of comprehensive treatment plans, further driving market growth.

Technological Innovations in Device Design

Technological advancements in the design and manufacturing of orthopedic devices are significantly influencing the market in France. Innovations such as 3D printing, robotics, and smart materials are enhancing the functionality and effectiveness of orthopedic solutions. For instance, 3D-printed implants allow for customized solutions tailored to individual patient anatomies, improving surgical outcomes. The orthopedic devices market is witnessing a surge in investment in research and development, with companies allocating substantial budgets to innovate. This focus on technology is expected to drive market growth, as more healthcare facilities adopt cutting-edge devices to enhance surgical precision and recovery times. The integration of technology into orthopedic devices is likely to reshape the landscape of orthopedic care in France.