Rising Incidence of STDs

The increasing incidence of sexually transmitted diseases (STDs) in France is a critical driver for the std testing-devices market. Recent data indicates that the rates of infections such as chlamydia and gonorrhea have risen by approximately 30% over the past five years. This alarming trend has prompted both healthcare providers and individuals to seek more accessible and efficient testing solutions. As awareness of STDs grows, the demand for testing devices that offer rapid and accurate results is likely to surge. Consequently, manufacturers are focusing on developing innovative testing technologies that cater to this rising need, thereby expanding the std testing-devices market. The urgency to address public health concerns related to STDs is expected to further stimulate market growth in the coming years.

Government Initiatives and Funding

Government initiatives aimed at combating STDs in France play a significant role in driving the std testing-devices market. The French government has allocated substantial funding to enhance public health campaigns and improve access to testing services. For instance, recent budgets have included millions of euros dedicated to increasing the availability of testing devices in clinics and community health centers. These initiatives not only promote awareness but also facilitate the distribution of advanced testing technologies. As a result, the std testing-devices market is likely to experience growth due to increased accessibility and affordability of testing options. Furthermore, partnerships between government bodies and private sector companies may lead to innovative solutions that address the evolving needs of the population.

Technological Innovations in Testing

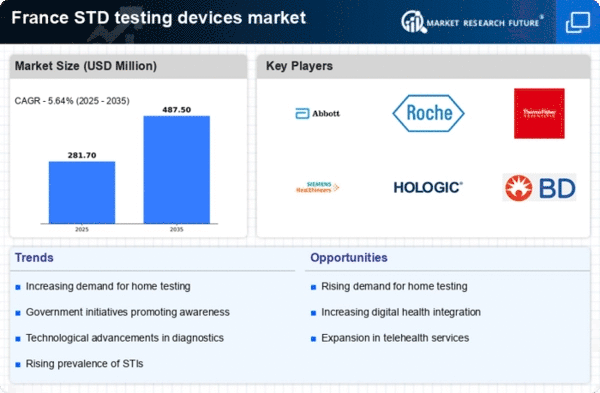

Technological innovations are reshaping the std testing-devices market in France. The introduction of point-of-care testing devices, which provide rapid results, is particularly noteworthy. These devices are designed to be user-friendly and can be utilized in various settings, including pharmacies and clinics. The market for these advanced testing solutions is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 15% over the next five years. Additionally, the integration of digital health technologies, such as mobile applications for result tracking, is enhancing user engagement and compliance. As these innovations continue to evolve, they are likely to attract more consumers to utilize testing services, thereby expanding the std testing-devices market.

Changing Attitudes Towards Sexual Health

Changing societal attitudes towards sexual health are influencing the std testing-devices market in France. There is a growing acceptance of discussing sexual health issues openly, which encourages individuals to seek testing without stigma. This cultural shift is particularly evident among younger populations, who are more proactive about their sexual health. Surveys indicate that approximately 60% of young adults in France are now more likely to get tested regularly. This trend is expected to drive demand for convenient and discreet testing options, further propelling the growth of the std testing-devices market. As awareness and acceptance continue to rise, manufacturers are likely to adapt their products to meet the preferences of this evolving demographic.

Increased Focus on Preventive Healthcare

The increased focus on preventive healthcare in France is a significant driver for the std testing-devices market. As healthcare systems shift towards preventive measures, the emphasis on early detection and treatment of STDs has intensified. Public health campaigns are promoting regular testing as a means to reduce transmission rates and improve overall health outcomes. This proactive approach is likely to lead to a higher demand for testing devices that are efficient and easy to use. Market analysts project that the std testing-devices market could see a growth rate of around 12% annually as more individuals prioritize their health and seek out testing solutions. The alignment of healthcare policies with preventive strategies is expected to create a favorable environment for market expansion.