Research Methodology on Freight Trucking Market

Introduction

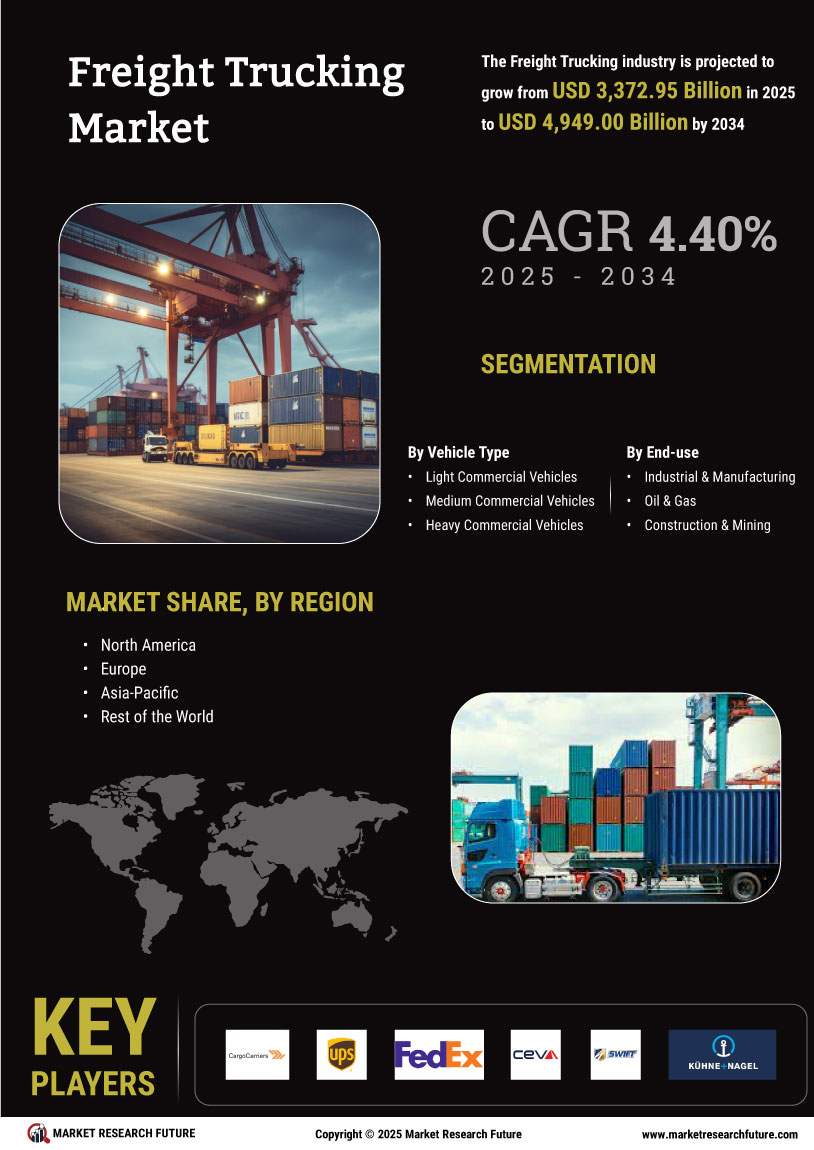

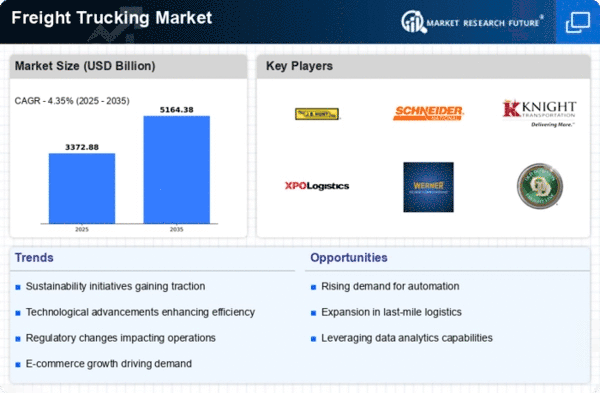

Market Research Future (MRFR) conducted a comprehensive study of the global Freight Trucking Market. The published research report analyzes the overall growth of the market and its various contributors, along with the major restraints and opportunities. This report looks at the current market trends and projections and provides insight into the expected market figures in future years.

Research Objectives

The primary objective of this research is to analyze the trends, drivers, and segmentation of the global Freight Trucking Market. This study aims to provide a clear understanding of the overall market dynamics, and its potential projections. Statistical models are developed to provide an in-depth understanding of the current and future growth trends of the global Freight Trucking Market.

Research Methodology

MRFR employs a combination of both primary and secondary research techniques to gain valuable insights into the global Freight Trucking Market. This report is developed through an extensive primary and secondary research methodology. Primary research techniques are conducted to gather information related to the size, share, and growth of the market. Secondary research techniques are conducted to explore additional resources, such as industry reports, magazines, newspapers, and various trade associations.

The market size estimates are derived through an in-depth analysis of the market figures published by key industry players and organizations. The data collected through primary and secondary research techniques are validated by industry experts, senior/eminent executives, and other external sources. The market figures are then calibrated and adjusted to arrive at a finalized projected size of the global Freight Trucking Market.

Global Freight Trucking Market Data Collection Approach

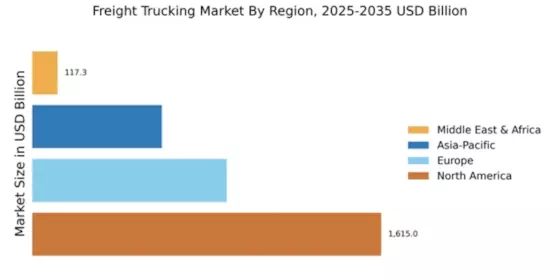

MRFR used the most reliable data collection tools to collect market data from various sources. These sources include industry statistics, syndicated information, regulatory bodies, magazines, and other public databases. MRFR experts conducted extensive market research and analyzed the global Freight Trucking Market based on the collected data. The market is segmented based on various factors, such as region, product type, and application.

Global Freight Trucking Market Study Literature

MRFR team reviewed literature and papers related to the global Freight Trucking Market. The studies are conducted by scholars, industry experts, trade associations, and various other sources. This enables MRFR to provide the most prolific data related to the trends and dynamics of the global Freight Trucking Market.

Assumptions

Based on the analysis of the collected data, MRFR assumed that every parameter and factor would remain constant throughout the forecast period. This is done to provide a more accurate view of the market. However, it is important to note that the actual market results may vary from the predicted statistic. These changes in market figures can be attributed to the changes in the overall economy and its related factors.

Conclusion

This comprehensive research report by Market Research Future provides an in-depth analysis of the global Freight Trucking Market. It offers a detailed view of the current and future trends and dynamics in the industry. The report also provides key figures, insights, and a reliable forecast about the growth of the market over the projected time. Additionally, this report offers suggestions and recommendations that could further drive market growth in the future.