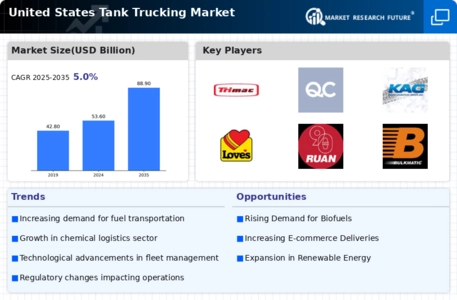

Rising Demand for Fuel Transportation

The US Tanker Truck Market is experiencing a notable increase in demand for fuel transportation, driven by the growing energy sector. As the United States continues to expand its oil and gas production, particularly in regions like the Permian Basin, the need for efficient and reliable tanker trucks becomes paramount. In 2025, the US produced approximately 12.5 million barrels of crude oil per day, necessitating a robust logistics network to transport this fuel. This surge in production is likely to propel the tanker truck market, as companies seek to optimize their supply chains and ensure timely delivery of fuel to various distribution points. Furthermore, the increasing reliance on tanker trucks for transporting refined products, such as gasoline and diesel, underscores the critical role these vehicles play in the energy landscape.

Infrastructure Development Initiatives

Infrastructure development initiatives across the United States are significantly influencing the US Tanker Truck Market. The federal government has allocated substantial funding for the enhancement of transportation infrastructure, including roads and highways, which are vital for tanker truck operations. In 2025, the Infrastructure Investment and Jobs Act is expected to inject billions into improving road conditions, thereby facilitating smoother and safer transportation for tanker trucks. This investment not only enhances the efficiency of logistics operations but also reduces wear and tear on vehicles, potentially lowering maintenance costs for fleet operators. As infrastructure improves, the tanker truck market is likely to see increased activity, as companies capitalize on better routes and reduced transit times.

Regulatory Changes and Compliance Requirements

Regulatory changes and compliance requirements are significant drivers of the US Tanker Truck Market. The US government has implemented various regulations aimed at ensuring the safe transportation of hazardous materials, including fuel. In 2025, the Federal Motor Carrier Safety Administration (FMCSA) is expected to introduce new guidelines that will impact tanker truck operations, necessitating upgrades in safety features and driver training programs. Compliance with these regulations is essential for companies to avoid penalties and ensure the safety of their operations. As a result, the tanker truck market may see increased demand for vehicles that meet these stringent standards, as companies strive to maintain compliance while optimizing their fleets.

Technological Innovations in Tanker Truck Design

Technological innovations in tanker truck design are playing a crucial role in shaping the US Tanker Truck Market. Advances in materials science and engineering have led to the development of lighter and more durable tanker trucks, which enhance fuel efficiency and payload capacity. In 2025, it is anticipated that the introduction of smart tanker trucks equipped with telematics and GPS tracking will revolutionize fleet management. These technologies enable real-time monitoring of vehicle performance and cargo conditions, thereby improving operational efficiency and safety. As companies increasingly adopt these innovations, the tanker truck market is likely to witness a shift towards more technologically advanced fleets, which can provide a competitive edge in logistics operations.

Evolving Consumer Preferences for Sustainable Practices

The US Tanker Truck Market is increasingly shaped by evolving consumer preferences for sustainable practices. As environmental awareness grows, companies are under pressure to adopt greener transportation methods. This shift is evident in the rising demand for tanker trucks that utilize alternative fuels, such as compressed natural gas (CNG) and biodiesel. In 2025, it is projected that approximately 20% of new tanker trucks will be equipped to run on alternative fuels, reflecting a significant change in the market landscape. Additionally, regulatory bodies are implementing stricter emissions standards, further incentivizing the adoption of eco-friendly vehicles. This trend not only aligns with consumer expectations but also positions companies favorably in a competitive market, as sustainability becomes a key differentiator.