E-commerce Growth

The rise of e-commerce is transforming the frozen cooked ready meals Market, providing consumers with greater access to a variety of frozen meal options. Online grocery shopping has gained traction, allowing consumers to conveniently order their favorite frozen meals from the comfort of their homes. This trend is supported by advancements in logistics and delivery services, which ensure that frozen products remain fresh and accessible. Market analysis indicates that e-commerce sales of frozen meals are expected to grow, as more consumers embrace online shopping for its convenience and efficiency. This shift may lead to increased competition among brands to enhance their online presence and offerings.

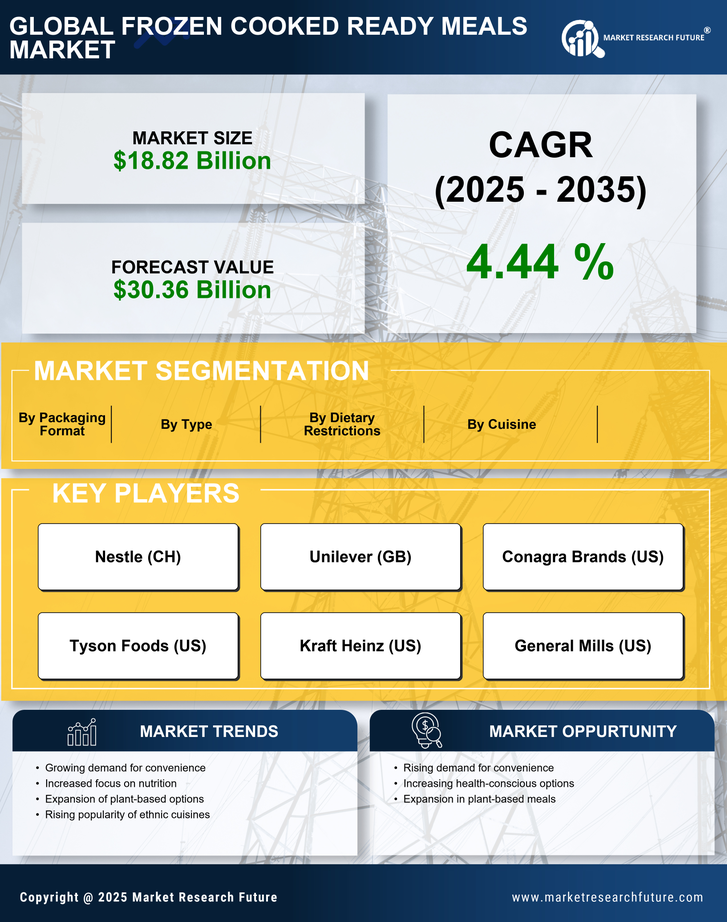

Diverse Flavor Profiles

The Frozen Cooked Ready Meals Market is experiencing a surge in demand for diverse flavor profiles that cater to a wide range of culinary preferences. As consumers become more adventurous in their eating habits, there is a growing interest in international cuisines and unique flavor combinations. This trend is reflected in the increasing variety of frozen meals available, from Asian-inspired dishes to Mediterranean flavors. Market data indicates that brands offering innovative and diverse meal options are likely to capture a larger share of the market, appealing to consumers who seek new and exciting dining experiences without the need for extensive cooking.

Health and Wellness Trends

Health and wellness trends are significantly influencing the Frozen Cooked Ready Meals Market. Consumers are increasingly seeking meals that align with their health goals, such as low-calorie, organic, or gluten-free options. This shift is prompting manufacturers to reformulate their products to meet these demands, resulting in a broader range of healthier frozen meal choices. Recent statistics suggest that the health-conscious segment of the market is expanding, with a notable increase in sales of nutritious frozen meals. As awareness of dietary choices continues to rise, the industry is likely to adapt further, focusing on providing meals that support a balanced lifestyle.

Convenience and Time-Saving

The demand for convenience in meal preparation is a primary driver of the Frozen Cooked Ready Meals Market. As lifestyles become increasingly hectic, consumers seek quick and easy meal solutions that do not compromise on quality. This trend is particularly evident among working professionals and busy families who prefer ready-to-eat options that can be prepared in minutes. According to recent data, the convenience food sector, which includes frozen meals, is projected to grow significantly, with a notable increase in sales of frozen cooked meals. This shift towards convenience is likely to continue, as consumers prioritize time-saving solutions in their daily routines.

Sustainability and Ethical Sourcing

Sustainability and ethical sourcing are becoming increasingly important in the Frozen Cooked Ready Meals Market. Consumers are more aware of the environmental impact of their food choices and are seeking products that align with their values. This has led to a rise in demand for frozen meals made from sustainably sourced ingredients and eco-friendly packaging. Brands that prioritize sustainability are likely to resonate with environmentally conscious consumers, potentially gaining a competitive edge in the market. Recent trends suggest that the emphasis on sustainability will continue to shape product development and marketing strategies within the industry, as companies strive to meet consumer expectations.