Health and Wellness Trends

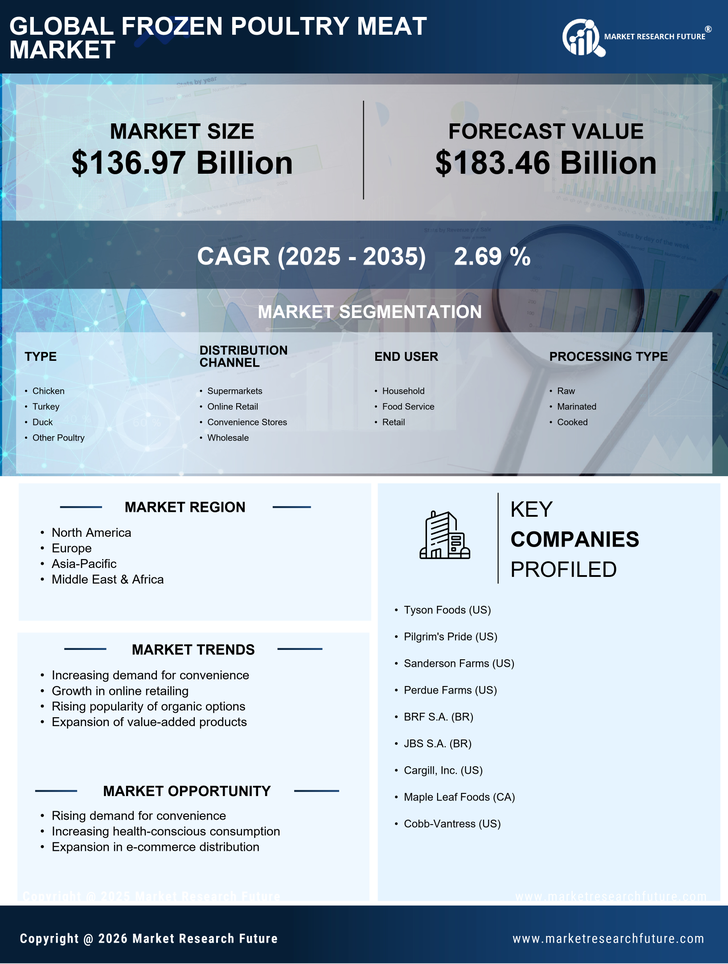

The frozen poultry meat Market is significantly influenced by the increasing health and wellness trends among consumers. There is a growing awareness regarding the nutritional benefits of poultry, which is perceived as a lean source of protein. Recent surveys indicate that nearly 70% of consumers are actively seeking healthier food options, which has led to a rise in the consumption of frozen poultry products. This shift is further supported by the industry's efforts to provide products that are free from antibiotics and hormones, aligning with consumer preferences for clean eating. As health consciousness continues to rise, the Frozen Poultry Meat Market is likely to see sustained growth, driven by the demand for nutritious and convenient food choices.

Rising Demand for Convenience Foods

The Frozen Poultry Meat Market experiences a notable surge in demand for convenience foods. As lifestyles become increasingly hectic, consumers are gravitating towards ready-to-cook and easy-to-prepare meal options. This trend is particularly pronounced among working professionals and busy families who seek to save time without compromising on nutrition. According to recent data, the convenience food sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This growth is likely to bolster the Frozen Poultry Meat Market, as frozen poultry products are often favored for their ease of use and longer shelf life, making them an attractive choice for consumers looking for quick meal solutions.

E-commerce Growth and Online Retailing

The rise of e-commerce and online retailing is transforming the Frozen Poultry Meat Market. With the increasing penetration of the internet and mobile devices, consumers are increasingly turning to online platforms for their grocery shopping. This shift is particularly evident in the frozen food segment, where convenience and home delivery options are highly valued. Recent statistics suggest that online grocery sales are expected to reach a substantial portion of total grocery sales in the coming years. This trend presents a significant opportunity for the Frozen Poultry Meat Market to expand its reach and cater to a broader audience. As more consumers embrace online shopping, the industry may witness a shift in purchasing patterns, further driving growth.

Increasing Global Population and Urbanization

The increasing The Frozen Poultry Meat Industry. As urban areas expand and populations grow, the demand for protein-rich food sources is expected to rise. Poultry, being one of the most affordable and accessible sources of protein, is likely to see increased consumption in urban settings. Projections indicate that the world population could reach approximately 9.7 billion by 2050, which will necessitate a significant increase in food production, including poultry. This demographic shift is likely to create a favorable environment for the Frozen Poultry Meat Market, as urban consumers often prefer the convenience and availability of frozen products.

Technological Advancements in Freezing Techniques

Technological advancements in freezing techniques are playing a pivotal role in enhancing the quality and safety of frozen poultry products. Innovations such as flash freezing and improved packaging methods are enabling the Frozen Poultry Meat Market to maintain the freshness and nutritional value of products for extended periods. These advancements not only improve product quality but also reduce food waste, which is a growing concern among consumers. The implementation of advanced freezing technologies is expected to contribute to a more efficient supply chain, thereby increasing the availability of frozen poultry products in various markets. As these technologies continue to evolve, they may further strengthen the competitive position of the Frozen Poultry Meat Market.