Health and Wellness Trends

The Frozen Processed Meat Market is increasingly influenced by health and wellness trends. Consumers are becoming more discerning about their food choices, seeking products that align with their health objectives. This trend has led to a rise in demand for frozen processed meats that are lower in sodium, free from preservatives, and enriched with nutrients. Market data suggests that products labeled as 'healthy' or 'natural' are gaining traction, with sales in this segment expected to grow by 6% annually. As health-conscious consumers continue to prioritize their well-being, the Frozen Processed Meat Market is likely to adapt by offering a wider range of healthier options, thereby catering to this evolving consumer base.

Increased Online Retailing

The Frozen Processed Meat Market is experiencing a transformation due to the rise of e-commerce platforms. With more consumers opting for online shopping, the accessibility of frozen processed meats has improved significantly. Recent statistics indicate that online grocery sales have surged, with frozen food categories, including processed meats, witnessing substantial growth. This shift towards digital retailing is prompting manufacturers to enhance their online presence and distribution strategies. As a result, the Frozen Processed Meat Market is likely to expand as companies leverage e-commerce to reach a wider audience, thereby increasing sales and market share.

Rising Protein Consumption

The Frozen Processed Meat Market is benefiting from the rising global demand for protein-rich foods. As dietary preferences shift towards higher protein intake, frozen processed meats are increasingly viewed as a convenient source of essential nutrients. Data suggests that the consumption of meat products is expected to rise by 2% annually, driven by health trends and dietary recommendations. This growing inclination towards protein consumption is prompting manufacturers to diversify their product offerings, including lean meats and value-added options. Consequently, the Frozen Processed Meat Market is likely to expand as consumers seek nutritious and convenient meal solutions that align with their health goals.

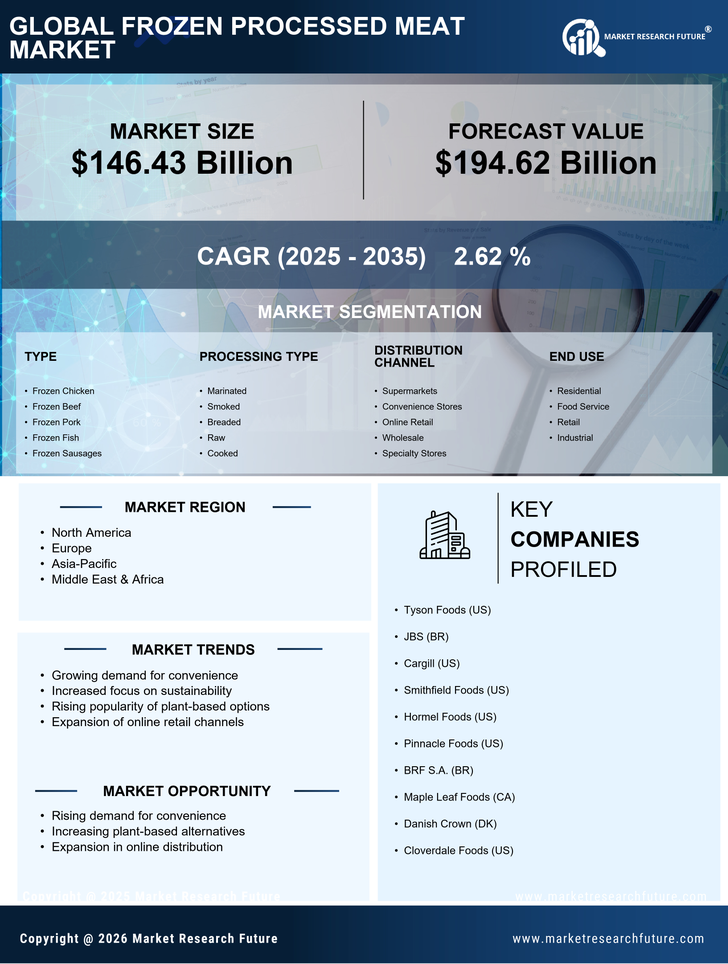

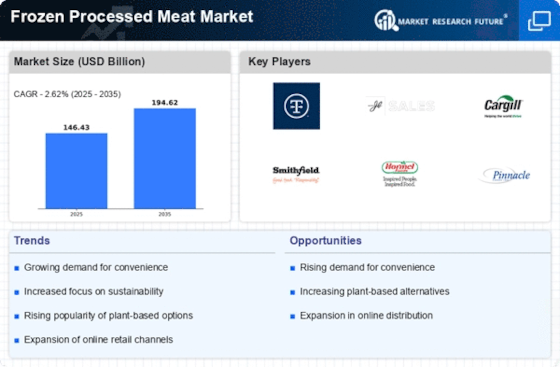

Convenience and Time-Saving

The Frozen Processed Meat Market is experiencing a surge in demand due to the increasing need for convenience among consumers. Busy lifestyles have led to a preference for ready-to-cook and easy-to-prepare meal options. According to recent data, the market for frozen processed meats is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This trend indicates that consumers are gravitating towards products that save time in meal preparation, allowing them to balance work and personal commitments more effectively. As a result, manufacturers are focusing on developing innovative frozen meat products that cater to this demand, thereby enhancing their market presence and profitability.

Innovative Product Development

The Frozen Processed Meat Market is witnessing a wave of innovation as companies strive to meet evolving consumer preferences. The introduction of new flavors, textures, and packaging formats is becoming increasingly prevalent. For instance, the market has seen a rise in plant-based frozen meat alternatives, appealing to a broader audience, including flexitarians and vegetarians. This innovation is not only attracting new customers but also enhancing brand loyalty among existing consumers. As a result, the market is projected to see a significant increase in sales, with estimates suggesting a potential growth of 5% in the next few years. This focus on product development is crucial for companies aiming to maintain competitiveness in the dynamic frozen processed meat landscape.