Regulatory Pressures and Compliance

The Fruits and Vegetables Crop Protection Market is significantly influenced by regulatory frameworks governing pesticide use and safety standards. Stricter regulations aimed at reducing chemical residues in food products compel manufacturers to innovate and develop safer crop protection solutions. Compliance with these regulations is essential for market access, particularly in regions with stringent food safety laws. As a result, companies are investing in research and development to create products that meet regulatory requirements while ensuring effective pest control. Market data indicates that the increasing complexity of regulatory landscapes is driving the demand for advanced crop protection technologies that are both effective and compliant. This trend underscores the importance of regulatory awareness in shaping product development and marketing strategies within the industry.

Increasing Demand for Organic Produce

The rising consumer preference for organic fruits and vegetables is a pivotal driver in the Fruits and Vegetables Crop Protection Market. As health-conscious consumers seek products free from synthetic pesticides, the demand for organic produce has surged. This trend is reflected in market data, indicating that organic fruits and vegetables account for a significant share of the overall produce market. Consequently, crop protection solutions that align with organic farming practices are increasingly sought after. This shift necessitates the development of innovative pest management strategies that comply with organic standards, thereby fostering growth in the crop protection sector. The emphasis on organic produce not only influences consumer purchasing behavior but also compels growers to adopt sustainable practices, further driving the demand for effective crop protection solutions.

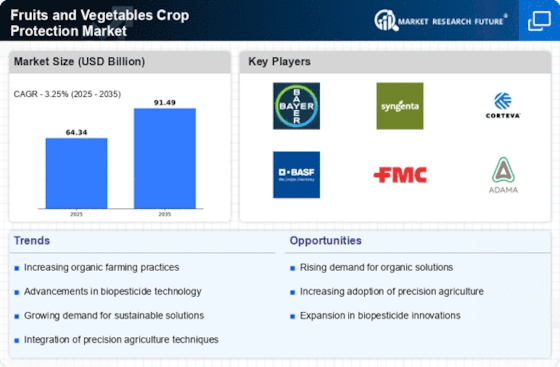

Technological Advancements in Crop Protection

Technological innovations are transforming the Fruits and Vegetables Crop Protection Market, offering new methodologies for pest and disease management. The integration of precision agriculture technologies, such as drones and satellite imagery, allows for more accurate monitoring of crop health and pest populations. This data-driven approach enhances the efficacy of crop protection measures, leading to improved yields and reduced chemical usage. Moreover, advancements in biopesticides and integrated pest management (IPM) strategies are gaining traction, as they provide environmentally friendly alternatives to traditional chemical pesticides. Market data suggests that the adoption of these technologies is likely to increase, as growers seek to optimize their operations and minimize environmental impact. The continuous evolution of technology in crop protection not only addresses current challenges but also positions the industry for future growth.

Consumer Awareness and Education on Food Safety

Consumer awareness regarding food safety and the impact of pesticides on health is a driving force in the Fruits and Vegetables Crop Protection Market. As consumers become more informed about the potential risks associated with pesticide residues, there is a growing demand for transparency in food production practices. This heightened awareness encourages growers to adopt safer and more sustainable crop protection methods, thereby influencing their purchasing decisions. Market data indicates that consumers are increasingly seeking produce that is certified as pesticide-free or grown using integrated pest management practices. This trend compels manufacturers to develop and market crop protection solutions that align with consumer preferences for safety and sustainability. The emphasis on food safety not only shapes consumer behavior but also drives innovation within the crop protection sector, as companies strive to meet evolving consumer expectations.

Rising Global Population and Food Security Concerns

The escalating The Fruits and Vegetables Crop Protection Industry, as it necessitates increased food production to ensure food security. With projections indicating that the world population could reach nearly 9.7 billion by 2050, the demand for fruits and vegetables is expected to rise correspondingly. This surge in demand places pressure on agricultural systems to enhance productivity while managing pest and disease threats effectively. Crop protection solutions play a crucial role in achieving these objectives, as they help safeguard yields against various biotic stresses. Market data suggests that the need for effective crop protection measures will intensify, as growers strive to meet the nutritional needs of a growing population. Consequently, the industry is likely to witness increased investment in innovative crop protection technologies to address these challenges.