Government Initiatives and Funding

Government initiatives and funding play a pivotal role in shaping the fuel cells for military unmanned aerial vehicle Market. Various defense agencies are allocating substantial budgets to research and development of fuel cell technologies. These investments are aimed at enhancing the operational capabilities of military UAVs while ensuring energy efficiency. Programs that support innovation in fuel cell applications are becoming increasingly common, with funding opportunities available for both established companies and startups. This financial backing is crucial for advancing technology and reducing costs associated with fuel cell production. As a result, the market is likely to see a significant influx of new players and technologies, potentially transforming the competitive dynamics within the industry.

Demand for Sustainable Energy Solutions

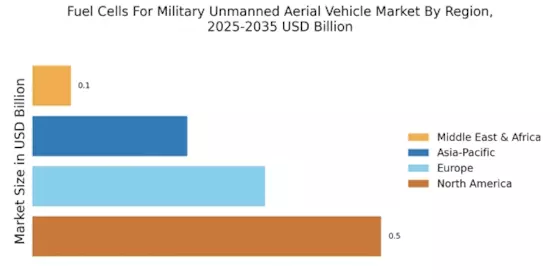

The growing emphasis on sustainability is a key driver for the fuel cells for military unmanned aerial vehicle Market. Military organizations are increasingly seeking environmentally friendly alternatives to traditional fossil fuels. Fuel cells offer a cleaner energy solution, producing only water and heat as byproducts. This aligns with global military strategies aimed at reducing carbon footprints and enhancing energy security. The shift towards sustainable energy solutions is not merely a trend; it reflects a broader commitment to environmental stewardship. As military operations expand, the demand for fuel cells is expected to rise, with projections indicating a market growth that could reach several billion dollars by the end of the decade. This transition is likely to influence procurement strategies and operational frameworks within military organizations.

Technological Advancements in Fuel Cells

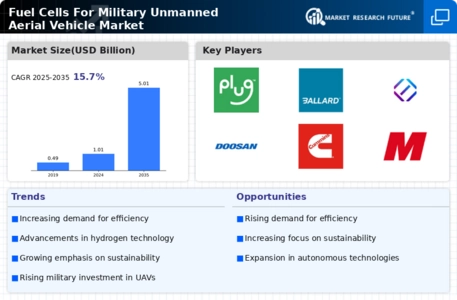

The Fuel Cells For Military Unmanned Aerial Vehicle Market is experiencing rapid technological advancements that enhance the efficiency and performance of fuel cell systems. Innovations in materials, such as proton exchange membranes and catalysts, are leading to improved energy density and reduced weight. These advancements allow unmanned aerial vehicles (UAVs) to operate for extended periods, which is crucial for military applications. The integration of advanced control systems and hybrid technologies further optimizes fuel cell performance, making them more viable for military operations. As a result, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This growth is driven by the increasing need for reliable and efficient power sources in military UAVs.

Strategic Collaborations and Partnerships

Strategic collaborations and partnerships are emerging as a significant driver in the Fuel Cells For Military Unmanned Aerial Vehicle Market. Companies are increasingly joining forces with research institutions and defense contractors to accelerate the development of advanced fuel cell technologies. These partnerships facilitate knowledge sharing and resource pooling, which can lead to innovative solutions tailored for military applications. For instance, collaborations between fuel cell manufacturers and UAV developers are yielding prototypes that demonstrate enhanced performance metrics. The market is witnessing a surge in joint ventures, with several partnerships announced in recent years. This collaborative approach is expected to enhance the competitive landscape, potentially leading to a market valuation that could exceed current estimates by a substantial margin.

Rising Military Expenditure on Advanced Technologies

Rising military expenditure on advanced technologies is a driving force in the Fuel Cells For Military Unmanned Aerial Vehicle Market. Nations are prioritizing investments in cutting-edge technologies to enhance their defense capabilities. Fuel cells, recognized for their potential to provide reliable and efficient power for UAVs, are increasingly being integrated into military budgets. This trend is particularly evident in countries focusing on modernization and technological superiority. The market is projected to benefit from this increased spending, with estimates suggesting that military budgets allocated to fuel cell technologies could double in the next five years. This surge in investment is likely to accelerate the development and deployment of fuel cell systems in military applications.