Expansion of E-commerce Activities

The Full Truckload Transportation Market is significantly influenced by the expansion of e-commerce activities. As online shopping continues to gain traction, the demand for efficient transportation solutions has escalated. In 2025, e-commerce sales are expected to reach unprecedented levels, necessitating robust logistics frameworks to support the distribution of goods. Full truckload services are particularly advantageous for e-commerce businesses, as they allow for the transportation of large volumes of goods in a single shipment, thereby reducing costs and improving delivery times. This trend is likely to drive further investments in the Full Truckload Transportation Market, as companies seek to enhance their logistics capabilities to meet consumer expectations.

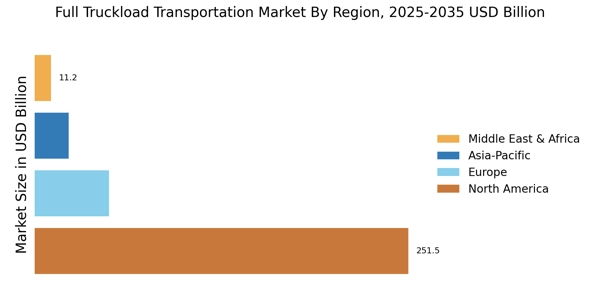

Growth in International Trade Activities

The Full Truckload Transportation Market is poised for growth due to the increase in international trade activities. As countries continue to engage in trade agreements and reduce tariffs, the movement of goods across borders is becoming more prevalent. In 2025, the value of international trade is projected to rise, leading to an increased demand for full truckload services that can efficiently transport goods over long distances. This trend is particularly relevant for industries such as agriculture and manufacturing, where timely delivery of products is essential. Consequently, the Full Truckload Transportation Market is likely to benefit from this expansion in trade, as companies seek reliable transportation solutions to navigate the complexities of international logistics.

Regulatory Changes and Compliance Requirements

The Full Truckload Transportation Market is also shaped by evolving regulatory changes and compliance requirements. Governments are increasingly implementing stringent regulations regarding safety, emissions, and driver working conditions. In 2025, compliance with these regulations is expected to become a critical factor for transportation companies. Firms that proactively adapt to these changes may gain a competitive advantage, as they can ensure uninterrupted service and avoid potential penalties. This regulatory landscape is likely to drive investments in compliance technologies and training programs within the Full Truckload Transportation Market, as companies strive to meet the new standards while maintaining operational efficiency.

Technological Advancements in Fleet Management

Technological advancements are reshaping the Full Truckload Transportation Market, particularly in fleet management. Innovations such as telematics, route optimization software, and automated tracking systems are enhancing operational efficiency. In 2025, it is anticipated that the adoption of these technologies will lead to a reduction in operational costs by up to 15%, as companies can better manage their fleets and optimize routes. This not only improves service delivery but also contributes to sustainability efforts by minimizing fuel consumption. As a result, the Full Truckload Transportation Market is likely to see increased investment in technology, as firms aim to leverage these advancements to gain a competitive edge.

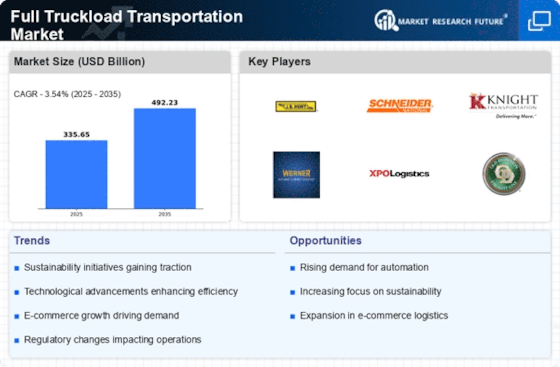

Rising Demand for Efficient Logistics Solutions

The Full Truckload Transportation Market is experiencing a surge in demand for efficient logistics solutions. As businesses strive to optimize their supply chains, the need for reliable transportation services has become paramount. In 2025, the market is projected to grow at a compound annual growth rate of approximately 4.5%, driven by the increasing complexity of logistics operations. Companies are seeking to reduce transit times and improve delivery reliability, which in turn fuels the demand for full truckload services. This trend is particularly evident in sectors such as retail and manufacturing, where timely delivery is critical to maintaining competitive advantage. The Full Truckload Transportation Market is thus positioned to benefit from this heightened focus on logistics efficiency.