Functional Composites Size

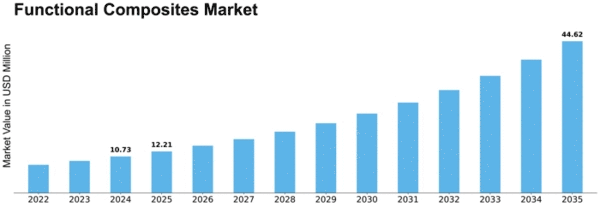

Functional Composites Market Growth Projections and Opportunities

The functional composites market is influenced by a myriad of factors, both internal and external, which collectively shape its dynamics. Market demand is a key driver, propelled by industries seeking lightweight, durable, and high-performance materials. Automotive, aerospace, construction, and electronics sectors are major consumers of functional composites, each with distinct requirements dictating market trends. Technological advancements play a crucial role, driving innovation and expanding the application spectrum of composites. As research yields new formulations and manufacturing techniques, functional composites become more accessible and versatile, further fueling market growth.

Functional Composites Market are compounds that possess special electrical, optical, and magnetic properties. The advantages of functional composites such as enhanced stiffness, high tensile strength, and high durability among others pave their way into many end-user industries.

Supply chain factors heavily impact the functional composites market. Availability of raw materials, particularly fibers and resins, influences production costs and product availability. The market's dependence on petroleum-based resins, for instance, subjects it to price fluctuations and supply chain disruptions. Additionally, the geographical distribution of manufacturing facilities affects market dynamics, with regions boasting robust infrastructure and skilled labor often dominating production and export markets.

Regulatory frameworks also exert significant influence on the functional composites market. Environmental regulations, in particular, are driving the shift towards sustainable and eco-friendly materials. As governments worldwide implement stricter emissions standards and waste management policies, industries are compelled to adopt greener alternatives, thereby shaping the demand for bio-based resins and recyclable fibers. Compliance with safety and quality standards is another regulatory aspect shaping market dynamics, as manufacturers strive to meet industry requirements and consumer expectations.

Global economic conditions are critical determinants of the functional composites market's trajectory. Economic growth fuels demand across end-user industries, driving investment in infrastructure and transportation, which in turn boosts the consumption of composites. Conversely, economic downturns can lead to decreased consumer spending and investment, impacting market demand and pricing. Currency fluctuations and trade policies also influence market dynamics, affecting the competitiveness of manufacturers in the global arena.

Consumer preferences and market trends play a pivotal role in shaping product development and marketing strategies within the functional composites market. With growing awareness of environmental issues and sustainability concerns, there is a rising demand for eco-friendly products and materials. Functional composites offering lightweight properties and enhanced performance characteristics are increasingly favored across various applications, driving innovation in product design and manufacturing processes. Additionally, aesthetic considerations such as color, texture, and finish are becoming increasingly important, particularly in consumer-facing industries like automotive and consumer electronics.

Technological advancements continue to revolutionize the functional composites market, enabling the development of novel materials and manufacturing techniques. Breakthroughs in nanotechnology, for example, are facilitating the production of composites with superior mechanical properties and enhanced functionality. Additive manufacturing processes are also revolutionizing the production of complex composite structures, offering greater design flexibility and cost-effectiveness. As these technologies mature and become more widely adopted, they will further drive market growth and diversification.

Leave a Comment