Research Methodology on Functional Safety Market

1. Introduction

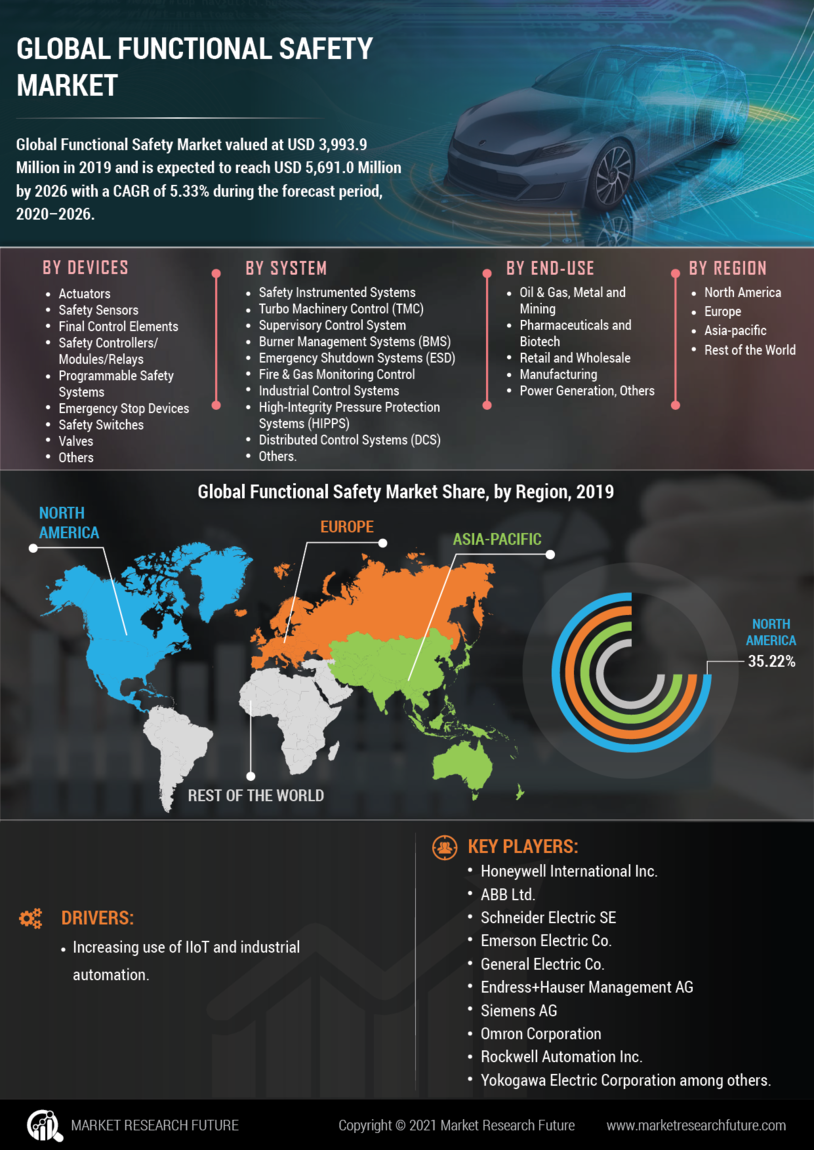

The Global Functional Safety Market is expected to register an impressive CAGR during the forecast period of 2023 to 2030. Functional Safety is a process that is used to maintain safety systems by managing potential risks to prevent accidents and harm to humans, property, and the environment. The safety of products and processes is the crucial goal of continuous improvement projects, which has created steady growth for the Functional Safety market.

Functional Safety has become a requirement for compliance with international standards, such as the IEC61508 and ISO26262, which forces organizations to apply Functional Safety principles to their products, processes, and activities. A strong emphasis on compliance with the standards for product safety and fault tolerance has witnessed a surge in the demand for Functional Safety products.

2. Research Methodology

The research report on the Global Functional Safety Market comprises a comprehensive study of the present trend, industry size, and share of this market. The report consists of a comprehensive analysis of the dynamics of the Global Functional Safety Market with an extensive focus on the market size & growth rate, trends, industry structure and factors that are propelling and restraining the growth of the market.

We used a combination of primary and secondary research methodologies to arrive at the market estimates. Secondary research involved a desk review of industry reports, statistical databases, company websites and other sources of information available publicly. This study provided us with a wide range of opinions and data points on the market and its characteristics.

For primary research, we conducted numerous interviews with experts from different verticals in the industry such as executives, industry pundits, engineers, industry consultants and other key opinion leaders in the industry. We then triangulated the research to arrive at a final market size.

We leveraged our extensive industry expertise and experience to develop a detailed survey questionnaire that was sent to the respondents to capture their inputs on different aspects of the market. The survey was conducted through interviews with industry experts, which included CEOs, CFOs, executives, directors, and other subjects belonging to the industry. It was conducted through face-to-face and telephonic interviews.

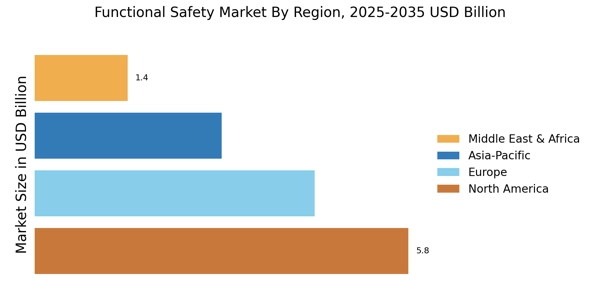

We have used in-depth secondary and primary research methodologies involving massive data collection and analysis of multiple regions. We have validated the data with relevant figures and diagrams. The report includes a detailed analysis of the Global Functional Safety Market, covering the global regions of North America, Europe, Asia-Pacific, South America and the Middle East & Africa.

Detailed questioning with the respondents was conducted to understand the market dynamics and their impact on the current and foreseeable growth rate of the market. All the data obtained from the research was then analyzed and compiled for charting, insights and further data extraction. Clear conclusions were made on the market segmentation, which will further be validated using sources including consumer feedback and case studies/employment surveys/demographic surveys.

We have carefully analyzed the size of the market in terms of both top-down and bottom-up approaches and validated with in-depth interviews of key opinion leaders and remote sensing of industry trends. The assessment of the market size has been further validated through our in-house model to estimate the potential of the Global Functional Safety Market.

3. Analysis

We have studied the key segments including product type, application, end user and country along with their respective share in the market. We have also studied how the different segments are driving the growth of the market.

Furthermore, we have also studied the customers in terms of user profiles, demographics and other important parameters. All of this helps in a better understanding of customer segmentation, a key aspect of driving market growth.

The report also covers other important aspects such as the competitive landscape where key players are studied in terms of market share and presence in different countries. We have also studied their product portfolios, financial information, recent developments and other key aspects.

We have also studied the company assessment based on various growth parameters. In addition, we have gathered company insights into quality, prices, service and other essential factors that are essential for market success.

The report also includes an extensive assessment of the market using Porter's five forces analysis as well as market attractiveness analysis. Key findings, key opportunities and threats and key trends have been identified and discussed in detail.

We have performed a quantitative and qualitative study of the market to assess the market potential, trends and forecasts. We analyzed competitive trends and analyzed the competitive landscape to identify key players, strategies, alliances and collaborations in the Global Functional Safety Market.

Furthermore, the report also covers a detailed analysis of all manufacturing and service providers, segment-wise and region-wise market size analysis, key investment analysis, and Porter's Five Forces Analysis.

Lastly, the report provides an overview of government regulations in the industry and suggests actions to be taken by players for market success and growth.

4. Conclusion

In conclusion, this report has provided an in-depth study of the Global Functional Safety Market, taking into account the key segments, their contribution to the market, the competitive landscape and key investment analysis. The report provides an in-depth analysis of the current trends driving the growth and the various strategies, regulations and measures being taken by the players to gain a foothold in the market. It is expected that the Global Functional Safety Market will continue to witness steady growth in the forecast period 2023 to 2030.