Investment in Smart City Initiatives

Investment in smart city initiatives is emerging as a crucial driver for the Garbage Truck Market. As cities strive to enhance urban living through technology, waste management is becoming increasingly integrated into smart city frameworks. This includes the deployment of smart bins that communicate fill levels to garbage trucks, optimizing collection routes and schedules. The Garbage Truck Market is projected to reach USD 2 trillion by 2025, with waste management being a key component. This trend suggests that the Garbage Truck Market will likely see increased demand for technologically advanced vehicles that can operate within these smart ecosystems, thereby improving overall efficiency and service delivery.

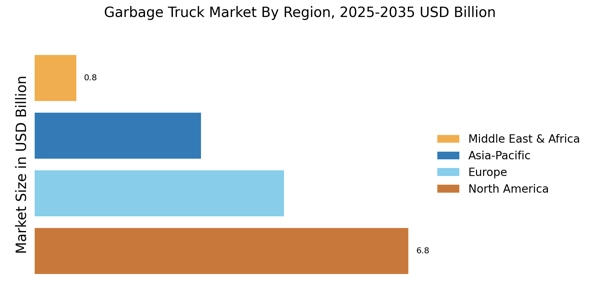

Increasing Urbanization and Population Growth

Urbanization and population growth are driving factors in the Garbage Truck Market. As more individuals migrate to urban areas, the demand for efficient waste management solutions escalates. The United Nations projects that by 2050, nearly 68% of the world’s population will reside in urban areas, necessitating an expansion in waste collection services. This trend is likely to result in a corresponding increase in the demand for garbage trucks, as municipalities seek to enhance their waste management capabilities. Consequently, the Garbage Truck Market is poised for growth, with an anticipated increase in sales of approximately 10% over the next five years to accommodate urban waste management needs.

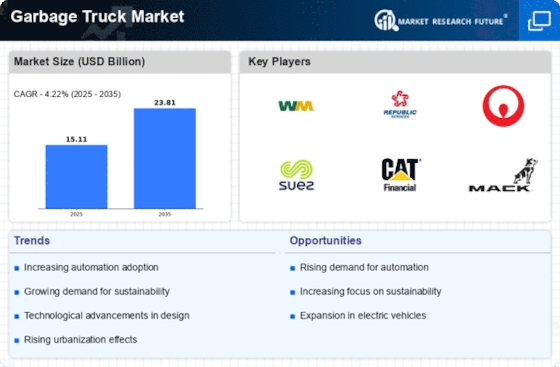

Technological Advancements in Waste Collection

The Garbage Truck Market is experiencing a notable shift due to technological advancements in waste collection systems. Innovations such as automated collection mechanisms and real-time tracking systems are enhancing operational efficiency. For instance, the integration of GPS technology allows for optimized routing, reducing fuel consumption and operational costs. According to recent data, the adoption of smart waste management solutions is projected to increase by 15% annually, indicating a growing trend towards efficiency in the Garbage Truck Market. These advancements not only improve service delivery but also contribute to sustainability efforts by minimizing the carbon footprint associated with waste collection.

Rising Demand for Waste Recycling and Management

The increasing emphasis on waste recycling and management is a pivotal driver in the Garbage Truck Market. As communities become more aware of the environmental impact of waste, there is a growing demand for efficient recycling programs. This trend is prompting municipalities to invest in specialized garbage trucks designed for dual collection of recyclables and general waste. Recent statistics indicate that the recycling market is expected to expand by 12% over the next five years, which will likely influence the design and functionality of garbage trucks. Consequently, the Garbage Truck Market is adapting to meet these evolving needs, ensuring that waste management practices align with recycling goals.

Environmental Regulations and Sustainability Initiatives

The Garbage Truck Market is significantly influenced by stringent environmental regulations and sustainability initiatives. Governments worldwide are implementing policies aimed at reducing landfill waste and promoting recycling. For example, many regions are mandating the use of eco-friendly vehicles, including electric and hybrid garbage trucks, to minimize emissions. This regulatory landscape is expected to drive innovation within the industry, as manufacturers adapt to meet these requirements. The market for electric garbage trucks is projected to grow by 20% annually, reflecting a shift towards sustainable waste management practices. As a result, the Garbage Truck Market is likely to evolve, focusing on environmentally responsible solutions.