Increasing Urbanization

The ongoing trend of urbanization in the United States is driving the demand for efficient waste management solutions, thereby impacting the garbage collection-vehicle market. As more people migrate to urban areas, the volume of waste generated increases significantly. According to the U.S. Census Bureau, urban areas are expected to house approximately 90% of the population by 2050. This demographic shift necessitates the deployment of advanced garbage collection vehicles that can navigate densely populated regions. Furthermore, municipalities are investing in modern fleets to enhance operational efficiency and reduce environmental impact. The garbage collection-vehicle market is likely to see a surge in demand as cities strive to maintain cleanliness and sustainability amid growing populations..

Rising Fuel Costs and Economic Factors

Fluctuating fuel prices and broader economic conditions are exerting pressure on the garbage collection-vehicle market. As fuel costs rise, waste management companies are compelled to seek more fuel-efficient vehicles to maintain profitability. The U.S. Energy Information Administration reports that diesel prices have seen significant volatility, impacting operational budgets for waste collection services. Consequently, there is a growing interest in alternative fuel vehicles, such as those powered by compressed natural gas (CNG) or electricity. This trend may lead to a transformation in the garbage collection-vehicle market, as companies adapt to economic pressures by investing in more sustainable and cost-effective solutions.

Public Awareness and Demand for Recycling

The increasing public awareness regarding recycling and waste reduction is shaping the garbage collection-vehicle market. As communities become more environmentally conscious, there is a heightened demand for efficient recycling programs. This shift is prompting waste management companies to invest in specialized vehicles designed for dual-stream collection, which separates recyclables from general waste. According to the National Recycling Coalition, recycling rates in the U.S. have improved, with some areas achieving rates above 35%. This trend indicates a growing market for vehicles that can accommodate diverse waste streams, thereby enhancing the overall efficiency of waste management operations.

Technological Advancements in Waste Management

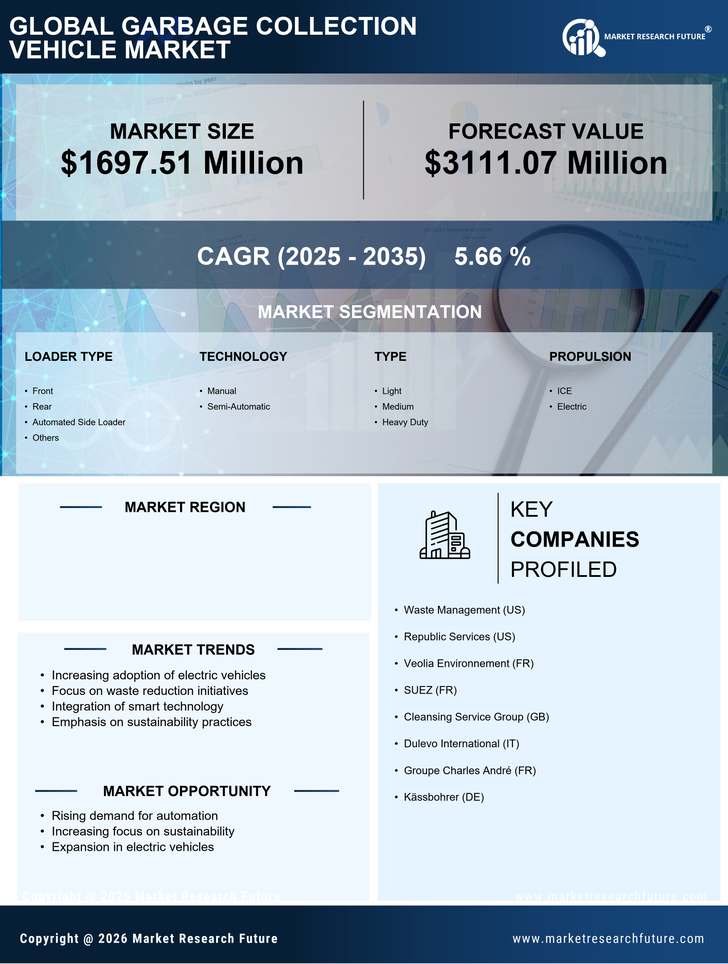

Technological innovations are reshaping the garbage collection-vehicle market, as new systems and equipment enhance operational efficiency. The integration of GPS tracking, route optimization software, and automated collection systems allows waste management companies to streamline their operations. For instance, the implementation of smart waste bins equipped with sensors can notify collection services when they are full, optimizing collection routes and reducing fuel consumption. The market for garbage collection vehicles is projected to grow as these technologies become more prevalent. Estimates suggest a potential increase in market size by 15% over the next five years.. This trend indicates a shift towards more intelligent waste management solutions.

Government Initiatives for Environmental Sustainability

Government initiatives aimed at promoting environmental sustainability are significantly influencing the garbage collection-vehicle market. Federal and state regulations are increasingly mandating the adoption of eco-friendly practices in waste management. For example, the Environmental Protection Agency (EPA) has set forth guidelines that encourage municipalities to invest in cleaner technologies. As a result, many local governments are transitioning to vehicles that meet stringent emissions standards. This shift not only aligns with regulatory requirements but also appeals to environmentally conscious citizens. The garbage collection-vehicle market is expected to expand as municipalities seek to comply with these regulations and enhance their public image..