Rise of Organic Gardening Practices

The Gardening Equipment Market is experiencing a shift towards organic gardening practices, driven by increasing consumer awareness of health and environmental issues. As more individuals seek to grow their own organic produce, the demand for specialized gardening equipment tailored for organic gardening is on the rise. Recent surveys indicate that nearly 50% of gardeners prioritize organic methods, which influences their purchasing decisions regarding tools and supplies. This trend presents a unique opportunity for the Gardening Equipment Market to develop and market products that align with organic gardening principles, such as biodegradable pots and natural pest control solutions. As the organic gardening movement continues to gain momentum, the Gardening Equipment Market is likely to see a corresponding increase in sales of organic gardening tools and equipment.

Increased Interest in Home Gardening

The Gardening Equipment Market experiences a notable surge in demand as more individuals embrace home gardening. This trend is driven by a growing awareness of the benefits of homegrown produce, including improved nutrition and cost savings. Recent data indicates that approximately 35% of households engage in some form of gardening, reflecting a shift towards self-sufficiency. The Gardening Equipment Market is likely to benefit from this trend, as consumers seek tools and equipment that enhance their gardening experience. Additionally, the rise of social media platforms has facilitated the sharing of gardening tips and success stories, further motivating individuals to cultivate their own gardens. As this interest continues to grow, the Gardening Equipment Market may see an increase in sales of essential tools such as shovels, trowels, and planters.

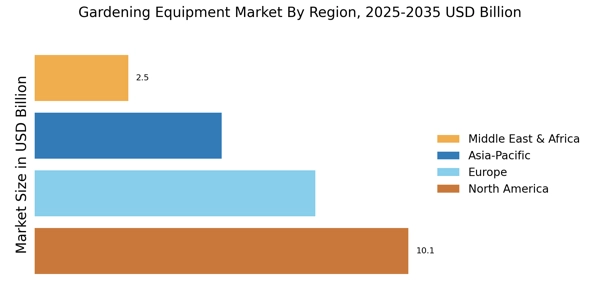

Urbanization and Limited Space Gardening

The Gardening Equipment Market is adapting to the challenges posed by urbanization, where limited space for gardening is a common concern. As more people reside in urban areas, the demand for compact and multifunctional gardening tools is increasing. Vertical gardening systems, container gardening solutions, and balcony planters are gaining popularity among city dwellers who wish to cultivate plants in small spaces. Market analysis indicates that the segment of gardening equipment designed for urban environments is projected to grow by approximately 15% over the next few years. This trend suggests that the Gardening Equipment Market must innovate and provide products that cater to the unique needs of urban gardeners. By focusing on space-saving solutions, the Gardening Equipment Market can tap into a growing consumer base that seeks to maximize their gardening potential in limited areas.

Technological Advancements in Gardening Tools

The Gardening Equipment Market is significantly influenced by technological advancements that enhance gardening efficiency and effectiveness. Innovations such as automated irrigation systems, smart sensors, and app-controlled gardening tools are becoming increasingly popular among gardening enthusiasts. These technologies not only simplify the gardening process but also promote sustainable practices by optimizing water usage and reducing waste. Market data suggests that the adoption of smart gardening solutions is expected to grow by over 20% in the next few years. This shift indicates a strong potential for the Gardening Equipment Market to expand its product offerings to include high-tech tools that cater to tech-savvy consumers. As gardening becomes more integrated with technology, the Gardening Equipment Market may witness a transformation in consumer preferences and purchasing behaviors.

Growing Awareness of Environmental Sustainability

The Gardening Equipment Market is increasingly influenced by a growing awareness of environmental sustainability among consumers. As individuals become more conscious of their ecological footprint, there is a rising demand for eco-friendly gardening products. This includes tools made from sustainable materials, as well as organic fertilizers and pest control options. Recent studies indicate that approximately 60% of consumers are willing to pay a premium for environmentally friendly gardening equipment. This trend presents a significant opportunity for the Gardening Equipment Market to align its product offerings with sustainable practices. By promoting eco-conscious products, the Gardening Equipment Market can attract environmentally aware consumers and potentially increase market share. As sustainability continues to be a priority for many, the Gardening Equipment Market is likely to evolve in response to these changing consumer preferences.