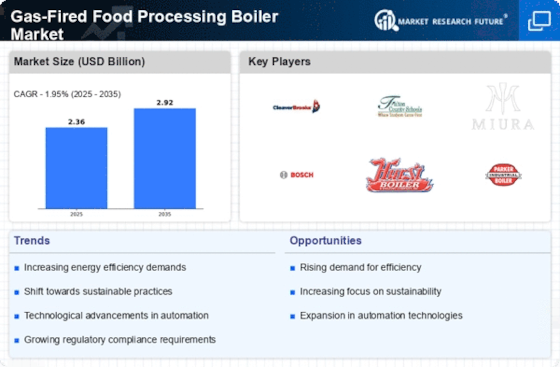

Rising Demand for Processed Foods

The increasing consumer preference for convenience foods is driving the Gas-Fired Food Processing Boiler Market. As lifestyles become busier, the demand for ready-to-eat and processed food products rises. This trend is reflected in market data, which indicates that the processed food sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. Consequently, food processing companies are investing in efficient gas-fired boilers to meet production demands while ensuring quality and safety. The ability of these boilers to provide consistent heat and steam is crucial for maintaining the integrity of food products, thereby enhancing their appeal in a competitive market.

Energy Efficiency and Cost Savings

The focus on energy efficiency is a significant driver for the Gas-Fired Food Processing Boiler Market. As energy costs continue to rise, food processing companies are seeking ways to reduce operational expenses. Gas-fired boilers are recognized for their efficiency, often achieving thermal efficiencies of over 90%. This efficiency translates into lower fuel consumption and reduced greenhouse gas emissions, making them an attractive option for manufacturers. Market analysis suggests that companies investing in energy-efficient technologies can realize substantial cost savings, which further incentivizes the adoption of gas-fired boilers in food processing applications.

Regulatory Compliance and Safety Standards

Stringent regulations regarding food safety and environmental standards are influencing the Gas-Fired Food Processing Boiler Market. Governments are increasingly enforcing laws that require food manufacturers to adopt cleaner and safer production methods. Gas-fired boilers, known for their lower emissions compared to coal or oil-fired systems, are becoming a preferred choice. Compliance with these regulations not only ensures the safety of food products but also helps companies avoid potential fines and legal issues. The market is witnessing a shift towards boilers that meet these stringent standards, which is likely to drive growth in the sector as manufacturers seek to align with regulatory requirements.

Technological Innovations in Boiler Design

Innovations in boiler technology are reshaping the Gas-Fired Food Processing Boiler Market. Advances such as modular boiler systems and improved combustion technologies enhance performance and reliability. These innovations allow for better heat distribution and reduced downtime, which are critical for food processing operations. Furthermore, the integration of smart technologies enables real-time monitoring and control, optimizing boiler performance. As food manufacturers increasingly prioritize operational efficiency, the demand for advanced gas-fired boilers is expected to rise, reflecting a broader trend towards modernization in the food processing sector.

Sustainability and Environmental Considerations

The growing emphasis on sustainability is a key driver for the Gas-Fired Food Processing Boiler Market. As consumers become more environmentally conscious, food manufacturers are compelled to adopt practices that minimize their carbon footprint. Gas-fired boilers, which produce fewer emissions compared to traditional fossil fuel systems, align with these sustainability goals. The market is witnessing a shift towards renewable gas options, such as biogas, which further enhances the environmental benefits of gas-fired systems. This trend not only meets consumer expectations but also positions companies favorably in a market increasingly focused on sustainable practices.

.png)