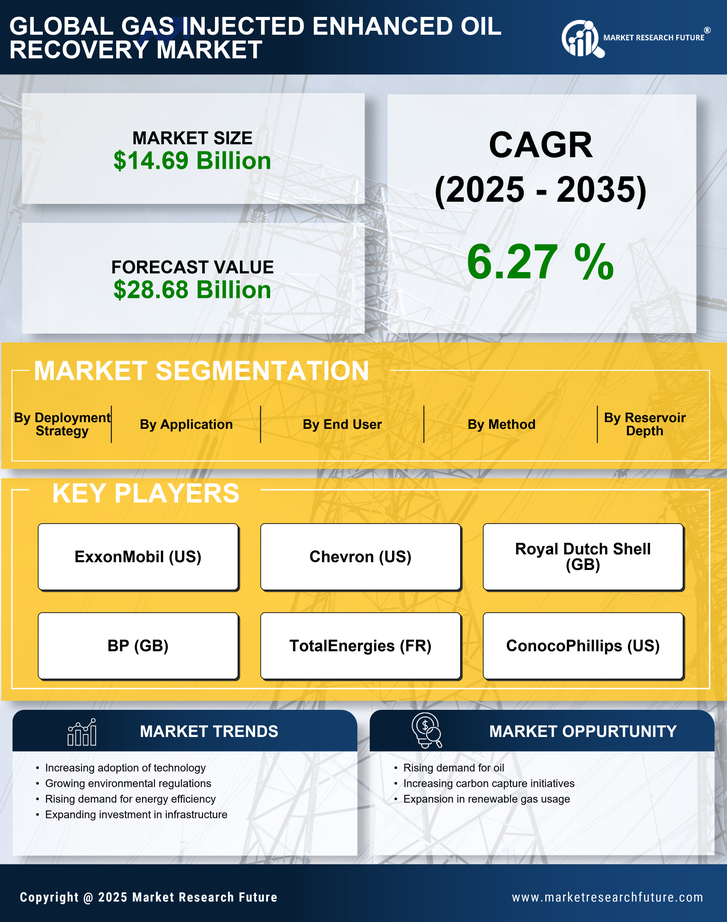

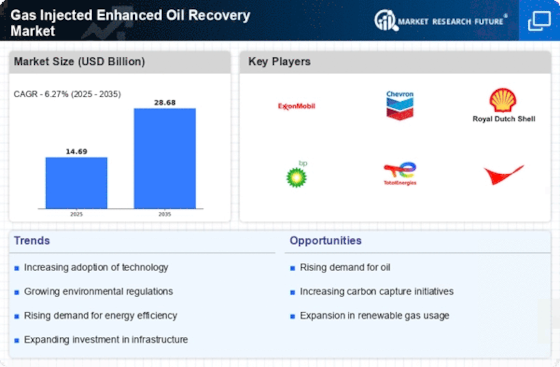

Economic Viability

The economic viability of gas injection methods is a key driver for the Gas Injected Enhanced Oil Recovery Market. As oil prices fluctuate, operators are compelled to seek cost-effective solutions to maintain profitability. Gas injection techniques can enhance recovery rates, thereby improving the overall economics of oil production. Studies indicate that the implementation of gas injection can lead to a reduction in the cost per barrel of oil produced, making it an attractive option for operators. Additionally, the potential for increased oil recovery can offset initial investment costs, further enhancing the economic appeal of gas injection methods. This economic rationale is likely to stimulate growth in the Gas Injected Enhanced Oil Recovery Market.

Rising Energy Demand

The increasing The Gas Injected Enhanced Oil Recovery Industry. As economies expand and populations grow, the need for oil continues to rise. According to recent estimates, global oil consumption is projected to reach approximately 104 million barrels per day by 2025. This surge in demand necessitates the optimization of existing oil fields, making enhanced oil recovery techniques, particularly gas injection, more appealing. Gas injection methods can significantly improve recovery rates, often exceeding 30% in mature fields. Consequently, the Gas Injected Enhanced Oil Recovery Market is likely to experience substantial growth as operators seek to maximize output from existing reserves.

Environmental Regulations

The evolving landscape of environmental regulations is influencing the Gas Injected Enhanced Oil Recovery Market. Governments worldwide are implementing stricter regulations aimed at reducing greenhouse gas emissions and promoting sustainable practices in the oil and gas sector. Enhanced oil recovery methods, particularly those utilizing gas injection, can potentially lower the carbon footprint of oil extraction processes. For example, CO2 injection not only enhances oil recovery but also aids in carbon sequestration, aligning with environmental goals. As regulatory frameworks become more stringent, operators may increasingly adopt gas injection techniques to comply with these regulations, thereby propelling the growth of the Gas Injected Enhanced Oil Recovery Market.

Technological Innovations

Technological advancements play a crucial role in shaping the Gas Injected Enhanced Oil Recovery Market. Innovations in drilling techniques, reservoir modeling, and gas injection methods have enhanced the efficiency and effectiveness of enhanced oil recovery processes. For instance, the integration of artificial intelligence and machine learning in reservoir management has improved decision-making and operational efficiency. Furthermore, advancements in gas injection technologies, such as CO2 and nitrogen injection, have shown promising results in increasing oil recovery rates. The market is expected to benefit from these technological innovations, which could lead to a more streamlined and cost-effective approach to oil extraction, thereby driving growth in the Gas Injected Enhanced Oil Recovery Market.

Investment in Mature Fields

Investment in mature oil fields is a significant driver for the Gas Injected Enhanced Oil Recovery Market. As many oil-producing regions face declining production rates, operators are turning to enhanced oil recovery techniques to revitalize these aging assets. Gas injection methods, such as CO2 and natural gas injection, have proven effective in extracting additional oil from mature fields. The International Energy Agency has indicated that enhanced oil recovery could account for up to 10% of total global oil production by 2030. This trend suggests that the Gas Injected Enhanced Oil Recovery Market will likely see increased investment as companies seek to maximize the potential of existing resources.