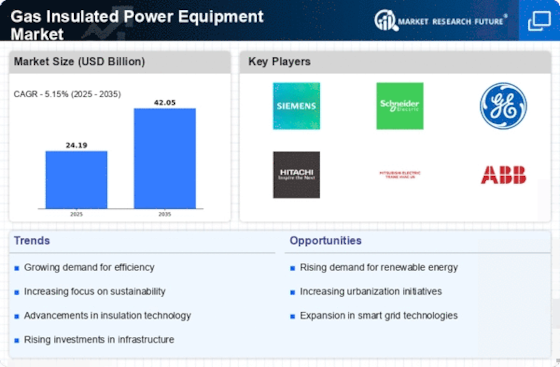

Rising Demand for Renewable Energy

The increasing emphasis on renewable energy sources is driving the Gas Insulated Power Equipment Market. As nations strive to meet their energy needs sustainably, the integration of renewable sources such as wind and solar power into the grid becomes essential. Gas insulated power equipment, known for its compact design and efficiency, plays a crucial role in facilitating this transition. In 2025, the demand for gas insulated substations is projected to rise by approximately 15%, reflecting the industry's adaptation to renewable energy integration. This shift not only enhances energy security but also aligns with global climate goals, thereby propelling the Gas Insulated Power Equipment Market forward.

Government Initiatives and Regulations

Government initiatives aimed at enhancing energy efficiency and reducing carbon emissions are significantly impacting the Gas Insulated Power Equipment Market. Regulatory frameworks that promote the adoption of cleaner technologies are encouraging utilities to invest in gas insulated solutions. For instance, various countries have implemented policies that mandate the use of environmentally friendly equipment in new installations. By 2025, it is anticipated that such regulations will lead to a 20% increase in the adoption of gas insulated technologies, thereby reinforcing the market's growth trajectory. This regulatory support is crucial for the Gas Insulated Power Equipment Market as it aligns with broader sustainability objectives.

Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development are pivotal factors influencing the Gas Insulated Power Equipment Market. As urban areas expand, the demand for reliable and efficient power distribution systems intensifies. Gas insulated equipment, with its space-saving attributes, is particularly suited for densely populated regions where land is at a premium. In 2025, urban centers are expected to account for over 60% of electricity consumption, necessitating advanced power solutions. This trend underscores the importance of gas insulated technology in modernizing urban infrastructure, thereby fostering growth within the Gas Insulated Power Equipment Market.

Increased Investment in Power Infrastructure

The surge in investment in power infrastructure is a critical driver for the Gas Insulated Power Equipment Market. As countries seek to upgrade aging electrical grids and expand capacity, the demand for advanced power solutions is escalating. Gas insulated equipment, known for its reliability and reduced footprint, is becoming a preferred choice for new installations. In 2025, investments in power infrastructure are projected to exceed 500 billion dollars, with a significant portion allocated to gas insulated technologies. This influx of capital is likely to stimulate innovation and enhance the overall competitiveness of the Gas Insulated Power Equipment Market.

Technological Innovations in Equipment Design

Technological innovations in the design and functionality of gas insulated power equipment are driving advancements within the Gas Insulated Power Equipment Market. Enhanced insulation materials and improved gas mixtures are contributing to the efficiency and reliability of these systems. Innovations such as digital monitoring and control systems are also being integrated, allowing for real-time performance assessments and predictive maintenance. As of 2025, the market is expected to witness a surge in demand for smart gas insulated solutions, with a projected growth rate of 12%. This evolution in technology not only enhances operational efficiency but also positions the Gas Insulated Power Equipment Market as a leader in modern power distribution.