Market Growth Projections

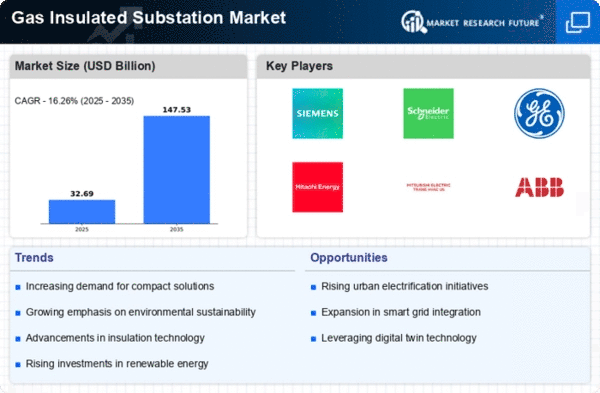

The Global Gas Insulated Substation Market Industry is poised for substantial growth, with projections indicating a market size of 28.1 USD Billion in 2024 and an anticipated increase to 147.5 USD Billion by 2035. This growth trajectory suggests a robust compound annual growth rate (CAGR) of 16.26% from 2025 to 2035. Such figures reflect the increasing reliance on gas insulated substations for efficient energy distribution, driven by factors such as urbanization, technological advancements, and government policies promoting renewable energy integration.

Government Initiatives and Policies

Government policies aimed at enhancing energy efficiency and reducing carbon emissions are pivotal in shaping the Global Gas Insulated Substation Market Industry. Many countries are implementing regulations that favor the adoption of gas insulated substations due to their lower environmental impact compared to traditional substations. Incentives for renewable energy projects often include provisions for modernizing grid infrastructure, which encompasses the installation of gas insulated substations. As these initiatives gain traction globally, they are expected to significantly boost market growth, aligning with the projected CAGR of 16.26% from 2025 to 2035.

Growing Demand for Renewable Energy

The transition towards renewable energy sources is a primary driver for the Global Gas Insulated Substation Market Industry. As countries strive to meet their energy needs sustainably, the integration of renewable sources such as wind and solar into the grid necessitates advanced infrastructure. Gas insulated substations, with their compact design and enhanced reliability, are increasingly favored for accommodating these energy sources. This trend is evident as investments in renewable energy are projected to reach unprecedented levels, thereby boosting the demand for gas insulated substations to ensure efficient energy distribution.

Increased Investment in Smart Grids

The global shift towards smart grid technologies is a crucial driver for the Global Gas Insulated Substation Market Industry. Smart grids facilitate better energy management and distribution, necessitating the integration of advanced substations that can handle complex energy flows. Gas insulated substations are particularly well-suited for smart grid applications due to their reliability and compactness. As investments in smart grid infrastructure continue to rise, the demand for gas insulated substations is likely to increase correspondingly, supporting the overall growth of the market.

Urbanization and Infrastructure Development

Rapid urbanization across the globe is significantly influencing the Global Gas Insulated Substation Market Industry. As urban areas expand, the demand for reliable and efficient electricity distribution systems increases. Gas insulated substations, known for their space-saving characteristics, are particularly suited for urban environments where land is at a premium. Governments and municipalities are investing heavily in infrastructure development to support growing populations, which in turn drives the need for modern substations. This trend is expected to contribute to the market's growth, with the industry projected to reach 28.1 USD Billion in 2024.

Technological Advancements in Substation Design

Technological innovations in the design and operation of gas insulated substations are propelling the Global Gas Insulated Substation Market Industry forward. Enhanced monitoring systems, automation, and digitalization are making substations more efficient and reliable. These advancements not only improve operational performance but also reduce maintenance costs, making gas insulated substations a more attractive option for utility companies. As technology continues to evolve, it is likely that the market will see increased adoption of these advanced systems, further driving growth and potentially leading to a market valuation of 147.5 USD Billion by 2035.