Increasing Demand for Reliable Power Supply

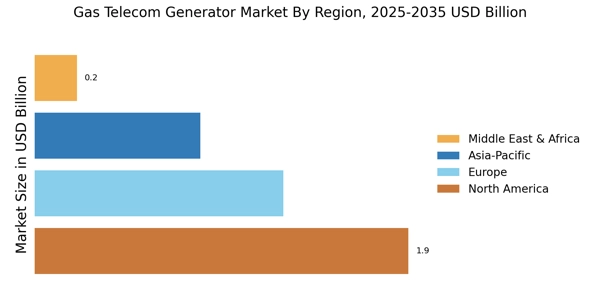

The Gas Telecom Generator Market is experiencing a surge in demand for reliable power supply solutions. As telecommunications infrastructure expands, the need for uninterrupted power becomes critical. This demand is driven by the increasing reliance on digital communication and the necessity for constant connectivity. In many regions, power outages can disrupt services, leading to significant financial losses. The market for gas telecom generators is projected to grow, with estimates suggesting a compound annual growth rate of around 5% over the next few years. This growth is indicative of the industry's response to the pressing need for dependable energy sources, particularly in remote and underserved areas.

Regulatory Support for Clean Energy Solutions

The Gas Telecom Generator Market is benefiting from regulatory frameworks that promote clean energy solutions. Governments are increasingly implementing policies aimed at reducing carbon emissions and encouraging the use of cleaner fuels. This regulatory support is likely to enhance the adoption of gas telecom generators, which are often viewed as a more environmentally friendly alternative to diesel generators. The market is expected to see a shift towards these cleaner technologies, with projections indicating that the share of gas generators in the telecom sector could rise significantly in the coming years. This trend aligns with broader sustainability goals and reflects a growing awareness of environmental impacts.

Expansion of Telecommunications Infrastructure

The Gas Telecom Generator Market is closely linked to the expansion of telecommunications infrastructure. As new technologies such as 5G are deployed, the demand for robust power solutions to support these networks is intensifying. This expansion is particularly evident in developing regions, where the need for reliable communication services is paramount. The market is projected to grow in response to this infrastructure development, with estimates indicating that investments in telecom infrastructure could reach several billion dollars in the next few years. This growth presents a significant opportunity for gas telecom generators, which are essential for maintaining operational continuity in these expanding networks.

Rising Energy Costs and Economic Considerations

The Gas Telecom Generator Market is influenced by rising energy costs, which compel telecommunications companies to seek more cost-effective power solutions. As traditional energy prices fluctuate, the appeal of gas generators, which often provide a more stable and predictable cost structure, becomes more pronounced. This economic consideration is driving a shift towards gas-powered solutions, as they can offer lower operational costs compared to diesel counterparts. Market analysts suggest that this trend may lead to an increased market share for gas telecom generators, particularly in regions where energy prices are volatile. The focus on cost efficiency is likely to shape purchasing decisions in the telecom sector.

Technological Innovations in Generator Efficiency

Technological advancements are playing a pivotal role in the Gas Telecom Generator Market. Innovations in generator design and fuel efficiency are leading to more effective and economical solutions for telecommunications providers. Enhanced efficiency not only reduces operational costs but also minimizes environmental impact, making these generators more appealing to companies focused on sustainability. Recent developments in hybrid systems, which combine gas generators with renewable energy sources, are particularly noteworthy. These innovations are expected to drive market growth, as they offer a dual benefit of reliability and reduced carbon footprint, potentially increasing market penetration in various regions.

Leave a Comment