Growing Need for Backup Power Solutions

The growing need for backup power solutions is a critical factor influencing the Global Diesel Fired Telecom Generator Market Industry. As the reliance on digital communication increases, telecom operators are prioritizing the establishment of robust backup systems to mitigate the risks associated with power failures. Diesel generators are favored for their reliability and quick deployment capabilities, making them ideal for emergency power supply. This increasing focus on resilience in telecommunications infrastructure is likely to drive demand for diesel generators, contributing to the overall market growth.

Increasing Demand for Reliable Power Supply

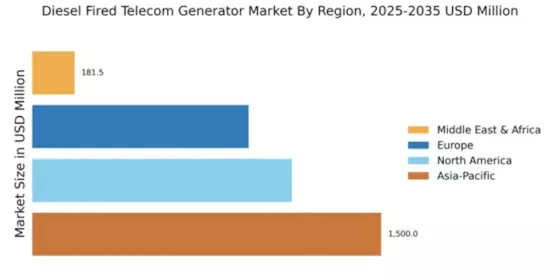

The Global Diesel Fired Telecom Generator Market Industry is experiencing a surge in demand for reliable power supply solutions, particularly in remote and off-grid areas. As telecommunications infrastructure expands, the need for uninterrupted power becomes critical. Diesel generators offer a dependable source of energy, ensuring that telecom operations remain functional even during power outages. This trend is particularly evident in developing regions where grid connectivity is inconsistent. The market is projected to reach 3.73 USD Billion in 2024, reflecting the growing reliance on diesel generators to support telecom networks.

Rising Telecommunications Sector Investments

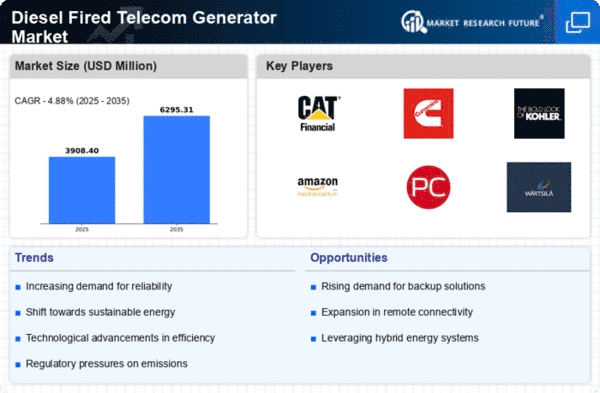

The rising investments in the telecommunications sector are fueling the Global Diesel Fired Telecom Generator Market Industry. With the expansion of mobile networks and the rollout of 5G technology, telecom operators are investing heavily in infrastructure to meet growing consumer demands. Diesel generators serve as a reliable power source for these new installations, ensuring that network operations remain uninterrupted. This trend is expected to sustain a compound annual growth rate of 4.87% from 2025 to 2035, indicating a robust market outlook driven by ongoing investments in telecommunications.

Technological Advancements in Generator Efficiency

Technological advancements in diesel generator efficiency are playing a pivotal role in the Global Diesel Fired Telecom Generator Market Industry. Innovations in engine design and fuel management systems have led to improved fuel consumption rates and reduced emissions. These enhancements not only lower operational costs but also align with global sustainability goals. As telecom companies seek to minimize their environmental impact, the adoption of advanced diesel generators becomes increasingly attractive. This shift is expected to contribute to the market's growth, with projections indicating a rise to 6.29 USD Billion by 2035.

Regulatory Support for Energy Infrastructure Development

Regulatory support for energy infrastructure development is a significant driver in the Global Diesel Fired Telecom Generator Market Industry. Governments worldwide are implementing policies that encourage investment in energy solutions, particularly in underserved regions. This regulatory environment fosters the growth of diesel generator installations, as they are often seen as a quick and effective means to enhance energy access. As nations prioritize telecommunications as a vital service, the demand for diesel generators is likely to increase, further propelling market growth in the coming years.