Expansion of Data Centers

The rapid expansion of data centers across the United States is significantly influencing the diesel generator market. As the demand for cloud computing and data storage increases, data centers require reliable power solutions to maintain operations. Diesel generators are often employed as backup power sources to ensure that these facilities remain operational during outages. The market for diesel generators in this sector is expected to grow by approximately 7% annually, driven by the need for continuous power supply and the increasing number of data centers being established. This trend highlights the critical role of diesel generators in supporting the digital infrastructure of the nation.

Rising Demand in Agriculture

The agricultural sector in the United States is witnessing a rising demand for diesel generators, which is contributing to the growth of the diesel generator market. Farmers and agricultural businesses rely on these generators for various applications, including irrigation, crop processing, and livestock management. The need for reliable power sources in remote farming locations is critical, especially during peak seasons. As agricultural technology advances, the integration of diesel generators into farming operations is becoming more prevalent. This trend suggests a potential growth rate of around 5% in the diesel generator market, driven by the essential role these generators play in enhancing productivity and operational efficiency in agriculture.

Growing Infrastructure Development

The diesel generator market is experiencing a notable surge due to the ongoing infrastructure development across the United States. With substantial investments in transportation, energy, and public facilities, the demand for reliable power sources is escalating. Diesel generators are favored for their robustness and efficiency, particularly in construction sites and remote locations where grid access is limited. According to recent data, the construction sector alone is projected to grow by approximately 5% annually, further driving the need for diesel generators. This trend indicates a strong correlation between infrastructure projects and the diesel generator market, as these generators provide essential backup power and support operations in various phases of construction.

Increased Energy Security Concerns

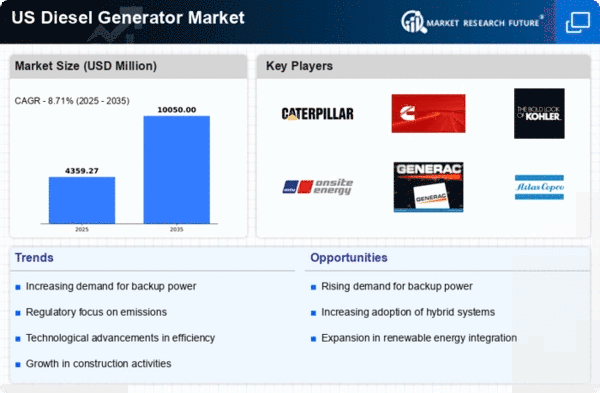

In the current climate, energy security has become a paramount concern for many sectors in the United States. The diesel generator market is benefiting from this heightened awareness, as businesses and institutions seek to ensure uninterrupted power supply. Events such as natural disasters and grid failures have underscored the importance of having reliable backup systems. As a result, organizations are increasingly investing in diesel generators to mitigate risks associated with power outages. The market is projected to grow at a CAGR of around 6% over the next five years, reflecting the rising emphasis on energy resilience and the critical role of diesel generators in maintaining operational continuity.

Regulatory Compliance and Standards

the diesel generator market is shaped by evolving regulatory compliance and standards in the United States. Industries are increasingly required to adhere to stringent emissions regulations, which has led to advancements in diesel generator technology. Manufacturers are focusing on producing generators that meet or exceed these standards, thereby enhancing their appeal in the market. The push for cleaner technologies is likely to drive innovation, resulting in more efficient and environmentally friendly diesel generators. This shift not only addresses regulatory requirements but also aligns with the growing demand for sustainable energy solutions, thereby positively impacting the diesel generator market.

.png)