Research Methodology on Diesel Generator Market

Abstract

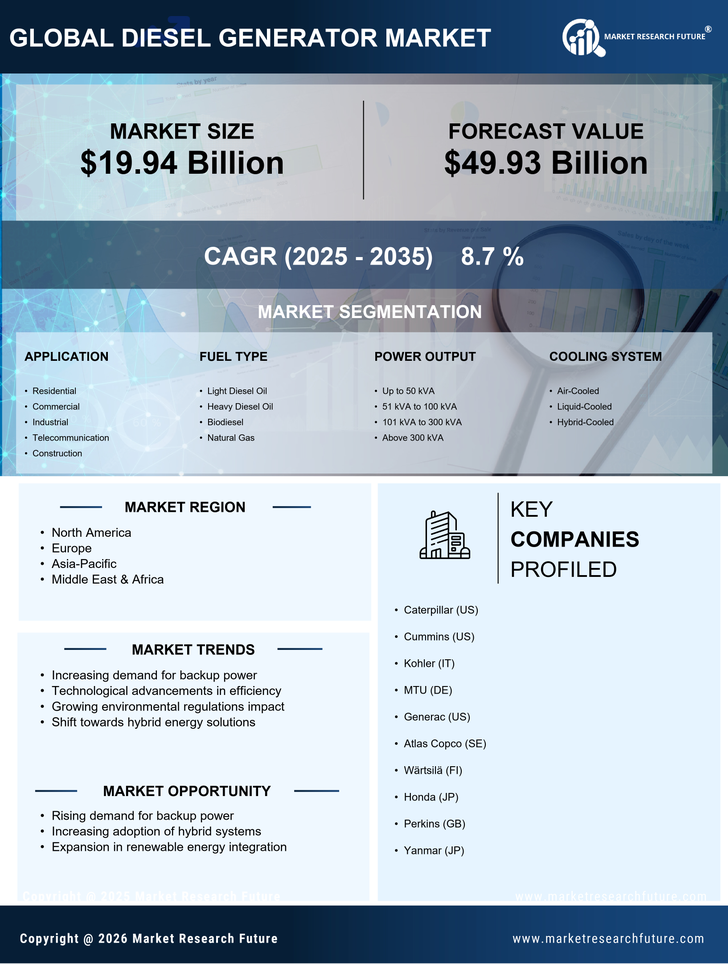

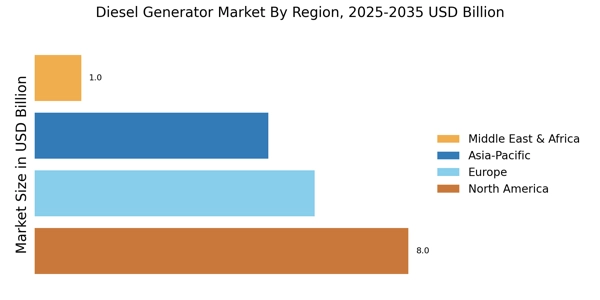

This research provides an overview of the Diesel Generator Market, which is expected to reach an all-time high revenue figure by 2030. The objective of the research is to accurately provide a deep dive analysis into the market and its major elements such as technology, size, segmentation, and competition. Besides, the major market drivers and trends, an overall assessment of the dynamics of the industry is also provided, along with detailed profiling of the major players operating in the Diesel Generator Market.

Introduction

The generator is a device used to generate electrical energy from a mechanical energy source. These generators are usually portable and are used for every kind of emergency. The most common diesel generator type is driven by an internal combustion engine to generate power. Diesel generators are used primarily in power generation plants and factories, as well as in the mining, agricultural, and automotive industries due to their high efficiency, reliability, and fuel savings.

Research Methodology

The research is conducted using a combination of primary and secondary methods, where information is gathered from industry sources, such as key market players and industry experts, as well as from published news articles and market reports. The methodology includes a market survey and exploratory research. The market was segmented based on product, application, and geographical location. The size of the market in terms of revenue is calculated based on these market segments.

Primary Research

Primary research is conducted by conducting industry interviews with the key market players. The questions posed to the participants cover their product portfolio, brand image, and strategies adopted to stay competitive. In addition, the interviews enable us to understand the prevailing market dynamics including market trends, industry drivers and restraints, opportunities and challenges, and distributor/supplier information.

Secondary Research

Secondary research is undertaken to complement the primary research with industry analysis. This involves examining published reports, journals, press releases, and trade and government websites. The data collated from the secondary research is combined with the primary research data to create a comprehensive view of the market landscape.

Data Collection

Data is collected from various sources including trade shows, industry experts, and existing reports, as well as personal interviews. Statistical tools are used to extract, analyze, and interpret data. The collected data is then evaluated and verified to ensure accuracy and authenticity.

Data Analysis

The collected data is analyzed using qualitative and quantitative tools to create a comprehensive view of the market. The data is examined, organized, and categorized. The results are then analyzed to identify the market trends and dynamics. After the collection and analysis of the data, a detailed report on the Diesel Generator Market is prepared, taking into consideration the competitive landscape, current market dynamics, and trends.

Conclusion

The data collected about the market is analyzed in-depth using qualitative and quantitative tools, and a comprehensive report is prepared. The report reveals that the market is primarily driven by the increasing demand for uninterrupted electricity supply and the growing use of diesel generators for disaster recovery solutions. The report also highlights the key players in the market and identifies that these players have adopted various strategies to gain a competitive edge in the market.