Aging Infrastructure and Equipment

The aging infrastructure and equipment in the power sector represent a significant driver for the Gas Turbine MRO in the Power Sector Industry. Many gas turbines currently in operation have surpassed their intended lifespan, leading to increased maintenance needs. As these turbines age, the likelihood of failures and inefficiencies rises, prompting operators to seek comprehensive MRO services to extend the life of their assets. Data suggests that nearly 40% of gas turbines in operation are over 20 years old, which necessitates a robust MRO strategy to mitigate risks associated with aging equipment. This trend not only drives demand for MRO services but also encourages investments in refurbishment and retrofitting.

Increasing Demand for Energy Efficiency

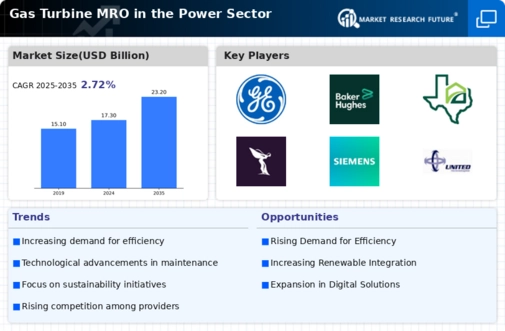

The rising demand for energy efficiency is a pivotal driver in the Gas Turbine MRO in the Power Sector. As energy costs continue to escalate, power generation companies are compelled to optimize their operations. This trend is reflected in the increasing investments in maintenance, repair, and overhaul services for gas turbines, which are essential for enhancing operational efficiency. According to recent data, The Gas Turbine MRO in the Power Sector is projected to reach USD 30 billion by 2026, with a significant portion allocated to MRO services. This focus on energy efficiency not only reduces operational costs but also aligns with regulatory pressures for lower emissions, thereby driving the need for advanced MRO solutions.

Shift Towards Renewable Energy Integration

The shift towards renewable energy integration is emerging as a key driver in the Gas Turbine MRO in the Power Sector Industry. As the energy landscape evolves, gas turbines are increasingly being utilized as flexible backup solutions to complement intermittent renewable sources like wind and solar. This transition necessitates a reevaluation of MRO strategies to ensure that gas turbines can operate efficiently in a hybrid energy environment. The International Renewable Energy Agency has projected that the integration of renewables could lead to a 15% increase in gas turbine MRO activities by 2030. This shift not only enhances the operational flexibility of power plants but also underscores the importance of maintaining gas turbines in optimal condition.

Technological Advancements in Turbine Design

Technological advancements in turbine design are significantly shaping the Gas Turbine MRO in the Power Sector Industry. Innovations such as improved materials, enhanced efficiency, and advanced control systems are leading to more complex turbine architectures. As these technologies evolve, the MRO requirements also become more sophisticated, necessitating specialized services and expertise. The market for gas turbine MRO is expected to grow at a CAGR of 4.5% through 2028, driven by the need for skilled technicians and advanced diagnostic tools. This trend indicates that as turbine designs become more advanced, the demand for tailored MRO solutions will likely increase, presenting opportunities for service providers to differentiate themselves.

Regulatory Compliance and Environmental Standards

Regulatory compliance and stringent environmental standards are crucial factors influencing the Gas Turbine MRO in the Power Sector Industry. Governments worldwide are implementing more rigorous regulations aimed at reducing carbon emissions and promoting cleaner energy sources. This regulatory landscape compels power generation companies to invest in MRO services that ensure their gas turbines meet these evolving standards. For instance, the International Energy Agency has indicated that compliance with emissions regulations could lead to a 20% increase in MRO expenditures over the next five years. Consequently, the need for regular maintenance and upgrades to meet compliance not only drives MRO demand but also fosters innovation in turbine technology.

Leave a Comment