Increasing Demand for Energy Efficiency

The Gas Turbine Services Market is experiencing a notable surge in demand for energy-efficient solutions. As industries and power generation sectors strive to reduce operational costs and enhance productivity, gas turbines are increasingly favored for their efficiency. According to recent data, gas turbines can achieve efficiency rates exceeding 60%, making them a preferred choice for energy generation. This trend is further fueled by regulatory frameworks that incentivize energy efficiency, compelling companies to invest in advanced gas turbine services. The focus on optimizing performance and minimizing waste is likely to drive the market, as stakeholders seek to align with sustainability goals while maintaining competitive advantage.

Expansion of Renewable Energy Integration

The integration of renewable energy sources into existing power grids is a pivotal driver for the Gas Turbine Services Market. As nations commit to ambitious renewable energy targets, gas turbines are increasingly utilized as flexible backup solutions to complement intermittent renewable sources like wind and solar. This hybrid approach not only stabilizes energy supply but also enhances grid reliability. Market data indicates that the share of gas turbines in the energy mix is projected to rise, with many countries investing in gas turbine services to ensure seamless integration. This trend underscores the importance of gas turbines in achieving energy transition goals while maintaining system resilience.

Technological Innovations in Turbine Design

Technological advancements in turbine design are significantly influencing the Gas Turbine Services Market. Innovations such as advanced materials, improved aerodynamics, and digital monitoring systems are enhancing the performance and reliability of gas turbines. These developments not only extend the operational lifespan of turbines but also reduce maintenance costs. For instance, the introduction of additive manufacturing techniques has enabled the production of complex turbine components with greater precision. As a result, operators are increasingly seeking specialized gas turbine services to leverage these innovations, thereby driving market growth. The ongoing research and development efforts in turbine technology are expected to further propel the industry forward.

Regulatory Support for Cleaner Energy Solutions

Regulatory frameworks promoting cleaner energy solutions are acting as a catalyst for the Gas Turbine Services Market. Governments worldwide are implementing policies aimed at reducing carbon emissions and enhancing energy efficiency. These regulations often favor the use of gas turbines, which are recognized for their lower emissions compared to coal-fired plants. As a result, there is a growing inclination among energy producers to invest in gas turbine services to comply with environmental standards. The alignment of regulatory support with market dynamics is expected to create a conducive environment for the growth of gas turbine services, as stakeholders seek to transition towards cleaner energy alternatives.

Rising Investments in Power Generation Infrastructure

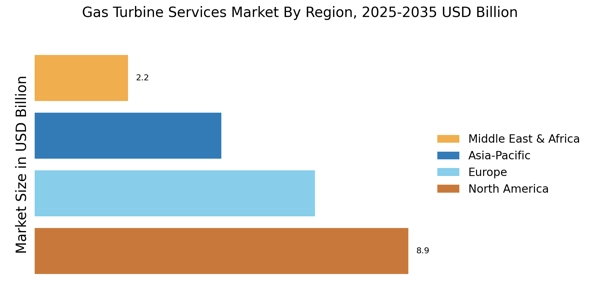

The Gas Turbine Services Market is benefiting from increased investments in power generation infrastructure across various regions. Governments and private entities are channeling funds into upgrading and expanding existing facilities to meet growing energy demands. This trend is particularly evident in emerging economies, where rapid industrialization necessitates reliable power sources. Market analysis reveals that investments in gas turbine services are projected to rise as stakeholders prioritize modernizing their energy infrastructure. The emphasis on building resilient and efficient power generation systems is likely to sustain demand for gas turbine services, ensuring the industry remains robust in the coming years.