Increasing Energy Demand

The rising energy demand across various sectors is a primary driver for the Gas Turbines in Thermal Power Market. As populations grow and economies expand, the need for reliable and efficient energy sources intensifies. According to recent data, energy consumption is projected to increase by approximately 25% by 2030. This surge necessitates the deployment of advanced gas turbine technologies, which offer higher efficiency and lower emissions compared to traditional coal-fired plants. Consequently, the Gas Turbines in Thermal Power Market is likely to experience substantial growth as utilities and independent power producers seek to meet this escalating demand while adhering to environmental regulations.

Environmental Regulations

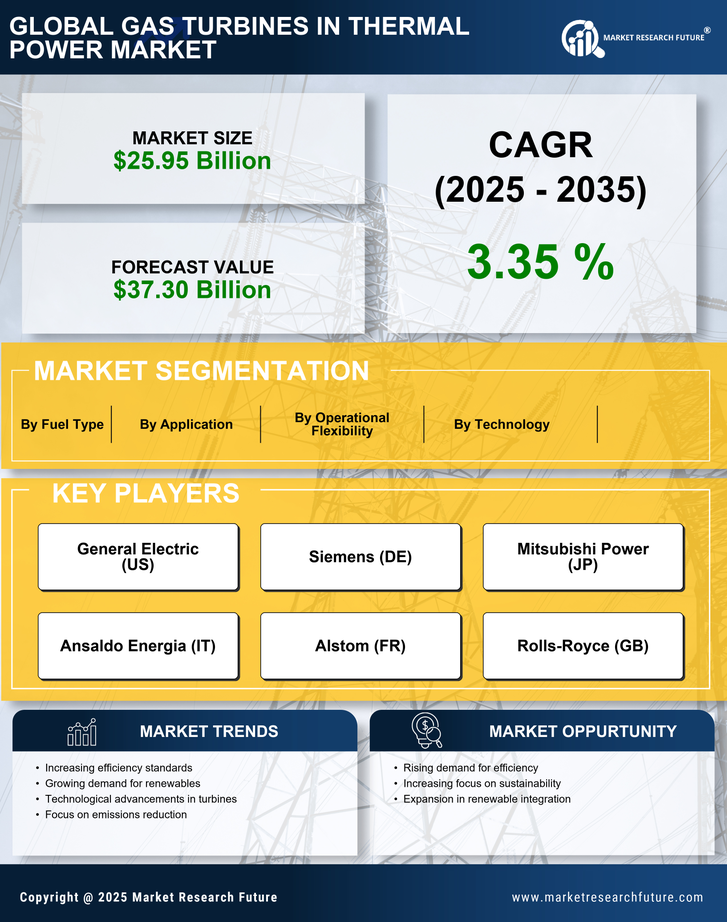

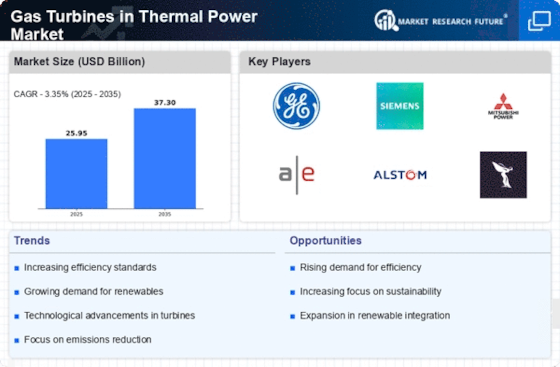

Stringent environmental regulations are shaping the landscape of the Gas Turbines in Thermal Power Market. Governments worldwide are implementing policies aimed at reducing greenhouse gas emissions and promoting cleaner energy sources. For instance, the introduction of carbon pricing mechanisms and emissions trading systems has incentivized the adoption of gas turbines, which emit significantly lower levels of pollutants compared to coal or oil. The market is expected to expand as utilities transition to gas-fired power generation to comply with these regulations, potentially leading to a market size increase of over 15% by 2027. This regulatory environment fosters innovation and investment in cleaner technologies within the Gas Turbines in Thermal Power Market.

Shift Towards Natural Gas

The shift towards natural gas as a primary fuel source is a significant driver for the Gas Turbines in Thermal Power Market. Natural gas is increasingly viewed as a cleaner alternative to coal, with lower carbon emissions and a more favorable environmental profile. This transition is supported by the availability of abundant natural gas reserves and advancements in extraction technologies, such as hydraulic fracturing. As countries aim to diversify their energy mix and enhance energy security, the demand for gas turbines is expected to rise. The Gas Turbines in Thermal Power Market could witness a growth trajectory that aligns with the increasing share of natural gas in the energy portfolio, potentially reaching a market value of USD 30 billion by 2028.

Technological Innovations

Technological innovations play a crucial role in driving the Gas Turbines in Thermal Power Market. Advancements in turbine design, materials, and control systems have led to improved efficiency and performance. For example, the development of combined cycle gas turbine (CCGT) systems has enabled power plants to achieve efficiencies exceeding 60%. Furthermore, ongoing research into digital technologies, such as predictive maintenance and real-time monitoring, enhances operational reliability and reduces downtime. As these innovations continue to evolve, they are likely to attract investment and drive growth in the Gas Turbines in Thermal Power Market, with projections indicating a compound annual growth rate of around 5% over the next five years.

Investment in Infrastructure

Investment in energy infrastructure is a pivotal driver for the Gas Turbines in Thermal Power Market. Many nations are prioritizing the modernization and expansion of their power generation capabilities to meet future energy needs. This includes the construction of new gas-fired power plants and the retrofitting of existing facilities with advanced gas turbine technologies. According to industry reports, global investments in energy infrastructure are expected to exceed USD 1 trillion by 2030. Such investments not only enhance energy reliability but also create opportunities for the Gas Turbines in Thermal Power Market to flourish. The influx of capital into this sector is likely to stimulate innovation and improve the overall efficiency of power generation systems.