Technological Advancements

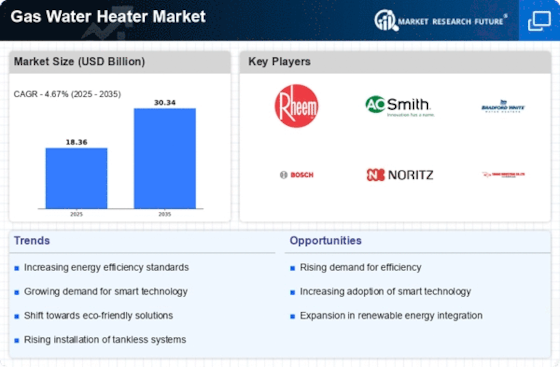

Technological advancements in gas water heater designs and functionalities are significantly influencing the Gas Water Heater Market. Innovations such as improved heat exchangers, enhanced insulation, and smart controls are making gas water heaters more efficient and user-friendly. The integration of smart technology allows for remote monitoring and control, appealing to tech-savvy consumers. Market data suggests that the adoption of these advanced features is on the rise, with manufacturers increasingly focusing on developing products that meet modern consumer expectations. This trend not only enhances user experience but also contributes to energy savings, positioning the Gas Water Heater Market favorably in a competitive landscape.

Rising Demand for Hot Water

The increasing demand for hot water in residential and commercial sectors is a primary driver for the Gas Water Heater Market. As households and businesses prioritize comfort and convenience, the need for reliable hot water solutions has surged. According to recent data, the residential segment accounts for a substantial share of the market, driven by factors such as population growth and urbanization. This trend is expected to continue, with projections indicating a steady increase in the installation of gas water heaters. The Gas Water Heater Market is likely to benefit from this rising demand, as consumers seek efficient and cost-effective solutions to meet their hot water needs.

Cost-Effectiveness of Gas Water Heaters

The cost-effectiveness of gas water heaters compared to electric alternatives is a notable driver for the Gas Water Heater Market. Gas water heaters typically have lower operational costs, making them an attractive option for consumers looking to reduce their energy bills. Market analysis indicates that the initial investment in gas water heaters is often offset by long-term savings on energy costs. This financial advantage is particularly appealing in regions where natural gas prices remain stable or lower than electricity rates. As consumers become more budget-conscious, the Gas Water Heater Market is expected to experience increased demand for gas-powered solutions that offer both efficiency and affordability.

Regulatory Support for Energy Efficiency

Regulatory support aimed at promoting energy efficiency is a crucial driver for the Gas Water Heater Market. Governments worldwide are implementing stringent energy efficiency standards and incentives to encourage the adoption of more efficient heating solutions. These regulations often mandate the use of high-efficiency gas water heaters, which can significantly reduce energy consumption and greenhouse gas emissions. As a result, manufacturers are compelled to innovate and produce compliant products, thereby expanding their market reach. The Gas Water Heater Market is likely to see growth as consumers become more aware of these regulations and seek to invest in energy-efficient solutions that align with governmental initiatives.

Growing Awareness of Environmental Impact

The growing awareness of environmental impact and the need for sustainable energy solutions are driving changes in the Gas Water Heater Market. Consumers are increasingly seeking products that minimize their carbon footprint, leading to a preference for energy-efficient gas water heaters. This shift is supported by educational campaigns and information dissemination regarding the benefits of using gas over electric heating solutions. Market data suggests that environmentally conscious consumers are more likely to invest in technologies that align with their values. Consequently, the Gas Water Heater Market is poised for growth as manufacturers respond to this demand by developing eco-friendly products that cater to the evolving preferences of consumers.

.png)