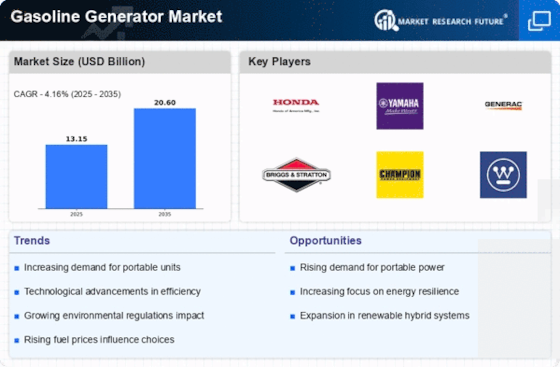

The gasoline generator market is currently characterized by a dynamic competitive landscape, driven by increasing demand for reliable power solutions across various sectors, including residential, commercial, and industrial applications. Key players such as Honda (Japan), Generac (US), and Briggs & Stratton (US) are strategically positioned to leverage their technological advancements and brand reputation. Honda (Japan) focuses on innovation, particularly in fuel efficiency and emissions reduction, while Generac (US) emphasizes its strong distribution network and customer service capabilities. Briggs & Stratton (US) is enhancing its product offerings through strategic partnerships and acquisitions, which collectively shape a competitive environment that is increasingly focused on technological differentiation and customer-centric solutions.In terms of business tactics, companies are localizing manufacturing to reduce costs and improve supply chain efficiency. The market structure appears moderately fragmented, with several players vying for market share. This fragmentation allows for niche players to thrive, while larger companies consolidate their positions through strategic maneuvers. The collective influence of these key players fosters a competitive atmosphere where innovation and operational efficiency are paramount.

In August Honda (Japan) announced the launch of its new line of eco-friendly gasoline generators, which utilize advanced hybrid technology to reduce fuel consumption by up to 30%. This strategic move not only aligns with global sustainability trends but also positions Honda as a leader in environmentally conscious power solutions. The introduction of these generators is likely to attract environmentally aware consumers and businesses, enhancing Honda's market share in a competitive landscape.

In September Generac (US) expanded its product portfolio by acquiring a small but innovative generator manufacturer specializing in portable power solutions. This acquisition is significant as it allows Generac to diversify its offerings and tap into the growing demand for portable generators, particularly in outdoor and emergency applications. The strategic importance of this move lies in Generac's ability to enhance its competitive edge through expanded product lines and increased market penetration.

In July Briggs & Stratton (US) launched a new digital platform aimed at improving customer engagement and service delivery. This platform integrates AI-driven analytics to provide real-time support and maintenance recommendations for users. The strategic importance of this initiative is profound, as it not only enhances customer satisfaction but also positions Briggs & Stratton at the forefront of digital transformation in the gasoline generator market.

As of October current competitive trends indicate a strong shift towards digitalization, sustainability, and the integration of AI technologies within the gasoline generator market. Strategic alliances are increasingly shaping the landscape, enabling companies to pool resources and expertise to drive innovation. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological advancements, sustainability initiatives, and supply chain reliability, reflecting the changing preferences of consumers and businesses alike.

.png)