Emergence of Smart Cities

The development of smart cities in the GCC is emerging as a significant driver for the 5g customer-premises-equipment market. Governments in the region are investing in smart city initiatives to enhance urban living through technology integration. These initiatives often require advanced connectivity solutions to support various applications, such as smart transportation, energy management, and public safety. The total investment in smart city projects in the GCC is projected to exceed $20 billion by 2025. As these projects unfold, the demand for customer-premises equipment that can facilitate high-speed, reliable connectivity will likely increase. This trend presents opportunities for manufacturers to develop specialized equipment tailored to the unique requirements of smart city infrastructures, thereby propelling growth in the 5g customer-premises-equipment market.

Rising Adoption of Smart Devices

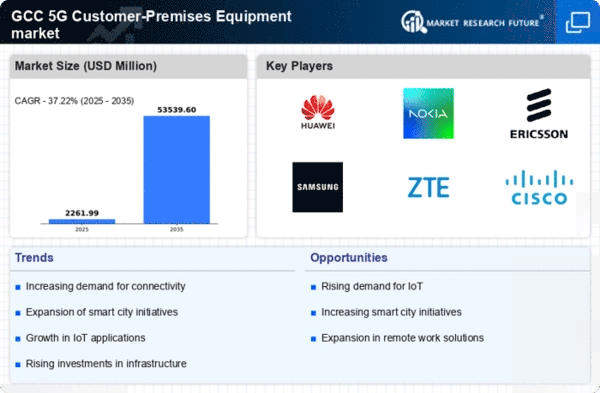

The proliferation of smart devices in the GCC region is a key driver for the 5g customer-premises-equipment market. As consumers increasingly adopt smartphones, tablets, and smart home devices, the demand for high-speed internet connectivity intensifies. Reports indicate that the number of smart devices per household is expected to rise by 30% by 2026, necessitating robust customer-premises equipment to support seamless connectivity. This trend is further fueled by the growing reliance on digital services, including streaming, gaming, and remote work solutions. Consequently, service providers are compelled to enhance their infrastructure, leading to a surge in investments in 5g customer-premises-equipment. The market is projected to witness a compound annual growth rate (CAGR) of 25% over the next five years, driven by this increasing adoption of smart devices.

Increased Focus on Digital Transformation

The GCC region is witnessing a robust push towards digital transformation across various sectors, which serves as a catalyst for the 5g customer-premises-equipment market. Organizations are increasingly adopting digital technologies to enhance operational efficiency and customer engagement. This shift is reflected in the projected growth of the digital economy in the GCC, which is expected to reach $100 billion by 2025. As businesses transition to digital platforms, the demand for reliable and high-speed connectivity becomes paramount. Consequently, the need for advanced customer-premises equipment that can support these digital initiatives is likely to rise. This trend not only benefits telecommunications providers but also opens avenues for collaboration with technology firms, thereby fostering innovation in the 5g customer-premises-equipment market.

Expansion of Telecommunications Infrastructure

The ongoing expansion of telecommunications infrastructure in the GCC is significantly impacting the 5g customer-premises-equipment market. Governments and private sector players are investing heavily in upgrading existing networks to accommodate 5g technology. For instance, the total investment in telecommunications infrastructure in the GCC is estimated to reach $50 billion by 2027. This investment is aimed at enhancing network capacity and coverage, which is essential for supporting the growing demand for high-speed internet. As a result, the deployment of advanced customer-premises equipment becomes crucial to ensure compatibility with the new infrastructure. The market is likely to benefit from this expansion, as it creates opportunities for manufacturers and service providers to introduce innovative solutions tailored to the evolving needs of consumers and businesses alike.

Growing Demand for Enhanced Security Solutions

The rising concern over cybersecurity threats in the GCC is driving the demand for enhanced security solutions within the 5g customer-premises-equipment market. As more devices become interconnected, the potential for cyberattacks increases, prompting businesses and consumers to seek robust security measures. The market for cybersecurity solutions in the region is expected to grow by 20% annually, reflecting the urgency for secure connectivity. This trend necessitates the integration of advanced security features into customer-premises equipment, ensuring that users can enjoy high-speed internet without compromising their data safety. Consequently, manufacturers are likely to focus on developing equipment that not only meets connectivity needs but also addresses security concerns, thereby shaping the future landscape of the 5g customer-premises-equipment market.

Leave a Comment