Technological Advancements in AI

The rapid evolution of artificial intelligence (AI) technologies is a primary driver for the affective computing market. In the GCC, advancements in machine learning and natural language processing are enabling systems to better understand and interpret human emotions. This capability is particularly valuable in sectors such as healthcare and customer service, where emotional intelligence can enhance user experience. The market for AI in the GCC is projected to reach approximately $20 billion by 2025, indicating a robust growth trajectory. As organizations increasingly adopt AI-driven solutions, the demand for affective computing technologies is likely to rise, fostering innovation and investment in this sector.

Growing Demand for Emotion Recognition

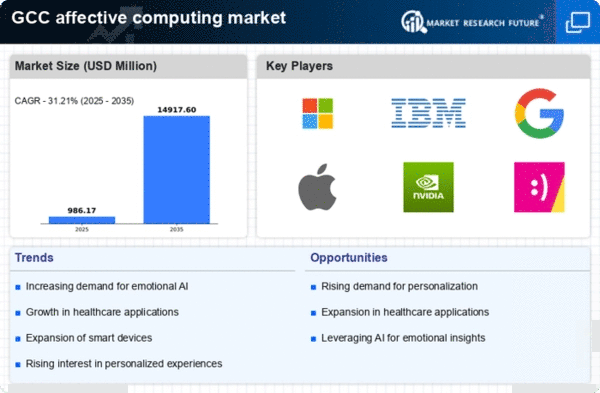

The increasing need for emotion recognition technologies is significantly influencing the affective computing market. In the GCC, businesses are recognizing the value of understanding customer emotions to improve engagement and satisfaction. For instance, the retail sector is leveraging affective computing to analyze customer reactions to products and services, thereby tailoring offerings to meet emotional needs. Reports suggest that the emotion recognition market in the region could grow at a CAGR of over 25% through 2025. This trend indicates a strong potential for companies to invest in affective computing solutions that enhance their ability to connect with consumers on a deeper emotional level.

Rising Focus on Mental Health Solutions

The growing awareness of mental health issues is driving demand for affective computing solutions in the GCC. Organizations are increasingly seeking technologies that can assist in monitoring and improving mental well-being. Affective computing tools can provide insights into emotional states, enabling timely interventions and support. The mental health market in the GCC is expected to expand significantly, with estimates suggesting a growth rate of around 15% annually. This trend highlights the potential for affective computing technologies to play a crucial role in developing innovative mental health solutions, thereby enhancing the overall quality of care in the region.

Enhanced User Experience in Digital Platforms

Enhancing user experience across digital platforms is a significant driver for the affective computing market. In the GCC, businesses are recognizing that understanding user emotions can lead to more engaging and effective digital interactions. Companies are investing in affective computing technologies to analyze user feedback and emotional responses, thereby refining their digital offerings. The digital transformation market in the region is expected to exceed $30 billion by 2025, indicating a strong potential for affective computing solutions to contribute to improved user experiences. This trend suggests that organizations prioritizing emotional engagement may gain a competitive edge in the rapidly evolving digital landscape.

Integration of Affective Computing in Education

The integration of affective computing technologies in education is emerging as a key market driver. In the GCC, educational institutions are increasingly adopting tools that can assess student emotions and engagement levels. This integration can lead to personalized learning experiences, improving educational outcomes. The education technology market in the region is projected to grow to $1 billion by 2025, suggesting a fertile ground for affective computing applications. As educators seek to create more responsive learning environments, the demand for affective computing solutions is likely to increase, fostering innovation in educational methodologies.