Technological Advancements in AI

The affective computing market is experiencing a surge due to rapid advancements in artificial intelligence (AI) technologies. These innovations enable machines to interpret human emotions more accurately, enhancing user experience across various applications. In the UK, the AI sector is projected to grow at a CAGR of 20% from 2025 to 2030, indicating a robust demand for affective computing solutions. Companies are increasingly investing in AI-driven tools that can analyze facial expressions, voice intonations, and physiological signals. This trend is likely to drive the development of sophisticated applications in sectors such as mental health, customer service, and entertainment, thereby expanding the reach of the affective computing market. As AI continues to evolve, it appears that the potential for creating more empathetic and responsive systems will significantly influence market dynamics.

Regulatory Support for Emotional AI

The UK government is increasingly recognising the importance of emotional AI technologies, which is positively influencing the affective computing market. Recent initiatives aimed at fostering innovation in AI have included provisions for ethical guidelines and funding opportunities for startups. This regulatory support is crucial for the development of affective computing applications that adhere to privacy and ethical standards. As the government invests in AI research and development, the market is likely to benefit from enhanced credibility and trust among consumers. Furthermore, the establishment of clear regulations may encourage more businesses to adopt affective computing technologies, thereby expanding the market landscape in the UK.

Increased Focus on Mental Health Solutions

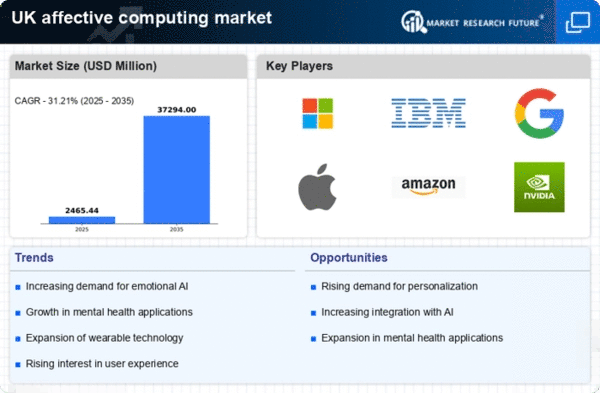

The rising awareness of mental health issues in the UK is driving the demand for innovative solutions within the affective computing market. With mental health becoming a priority for both individuals and organisations, there is a growing need for tools that can assist in monitoring and improving emotional well-being. The UK mental health technology market is expected to grow by 15% annually, reflecting a significant opportunity for affective computing applications. These technologies can provide real-time feedback on emotional states, enabling users to manage their mental health more effectively. As the stigma surrounding mental health continues to diminish, the integration of affective computing solutions into therapeutic practices is likely to expand, further propelling market growth.

Growing Demand for Personalised Experiences

In the UK, there is a notable shift towards personalised experiences across various industries, which is significantly impacting the affective computing market. Consumers increasingly expect products and services that cater to their individual preferences and emotional states. This demand is particularly evident in sectors such as retail and entertainment, where companies are leveraging affective computing technologies to tailor offerings based on user emotions. For instance, the market for personalised marketing solutions is anticipated to reach £2 billion by 2026, highlighting the financial potential of integrating emotional intelligence into customer interactions. As businesses strive to enhance customer satisfaction and loyalty, the affective computing market is likely to see substantial growth driven by this trend towards personalisation.

Rising Integration in Automotive Technologies

The automotive industry in the UK is increasingly integrating affective computing technologies to enhance driver and passenger experiences. With the advent of smart vehicles, there is a growing emphasis on creating emotionally aware systems that can respond to the emotional states of drivers. This integration is expected to improve safety and comfort, as vehicles equipped with affective computing capabilities can monitor driver fatigue and stress levels. The UK automotive market is projected to invest over £1 billion in smart technologies by 2027, indicating a strong potential for the affective computing market within this sector. As consumer expectations evolve, the demand for emotionally intelligent vehicles is likely to drive further innovation and growth in the affective computing market.