Rising Healthcare Expenditure

The increase in healthcare expenditure across the GCC is a significant driver for the circulating tumor-cell market. As governments prioritize healthcare infrastructure and services, there is a corresponding rise in funding for cancer research and treatment modalities. This financial support is likely to enhance the accessibility and affordability of circulating tumor-cell technologies, thereby expanding their adoption among healthcare providers. Recent data indicates that healthcare spending in the GCC is expected to reach $100 billion by 2026, which could facilitate the integration of advanced diagnostic tools into clinical settings. Consequently, the circulating tumor-cell market stands to gain from this upward trend in healthcare investment.

Increasing Demand for Early Detection

The rising awareness regarding the importance of early cancer detection is driving the growth of the circulating tumor-cell market. In the GCC region, healthcare providers are increasingly adopting advanced diagnostic tools that utilize circulating tumor cells for early-stage cancer identification. This shift is supported by a growing body of evidence suggesting that early detection can significantly improve patient outcomes. As a result, the market is projected to expand, with estimates indicating a potential growth rate of around 15% annually. The emphasis on preventive healthcare and early intervention strategies is likely to further bolster the demand for circulating tumor-cell technologies, making them a focal point in the region's oncology landscape.

Growing Focus on Personalized Medicine

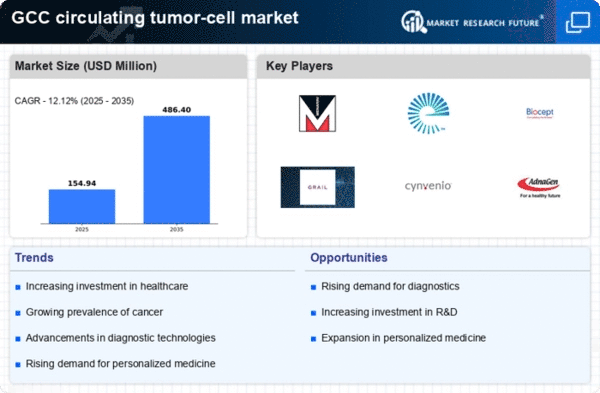

The trend towards personalized medicine is significantly influencing the circulating tumor-cell market. In the GCC, healthcare systems are increasingly recognizing the value of tailored treatment approaches based on individual patient profiles. Circulating tumor cells play a pivotal role in this paradigm shift, as they provide critical insights into tumor biology and treatment response. The market is likely to benefit from the integration of circulating tumor-cell analysis into routine clinical practice, with projections suggesting a market growth of around 12% over the next five years. This focus on personalized therapies aligns with global healthcare trends, positioning the circulating tumor-cell market as a key player in the evolution of cancer care.

Investment in Research and Development

Investment in research and development (R&D) within the GCC is a crucial driver for the circulating tumor-cell market. Governments and private entities are increasingly allocating funds to enhance cancer research, which includes the exploration of circulating tumor cells as biomarkers for various cancers. This financial commitment is expected to yield innovative diagnostic and therapeutic solutions, potentially leading to breakthroughs in cancer treatment. The market could witness a surge in new product launches, with R&D spending projected to reach approximately $500 million by 2027. Such investments not only foster technological advancements but also attract international collaborations, further enriching the circulating tumor-cell market.

Enhanced Collaboration Among Stakeholders

Enhanced collaboration among various stakeholders in the healthcare ecosystem is fostering growth in the circulating tumor-cell market. Partnerships between academic institutions, research organizations, and industry players are becoming increasingly common in the GCC. These collaborations aim to accelerate the development and commercialization of innovative circulating tumor-cell technologies. By pooling resources and expertise, stakeholders can address challenges in cancer diagnostics and treatment more effectively. This collaborative approach is expected to lead to the introduction of novel products and services, potentially increasing market share. The synergy created through these partnerships may also enhance the overall quality of cancer care in the region.