Shift to Remote Work Models

The transition to remote work has significantly influenced the cloud access-security-broker market, leading to increased demand for secure remote access solutions. As businesses in the GCC adopt flexible work arrangements, the reliance on cloud services has surged. This shift necessitates enhanced security protocols to ensure that remote access to corporate resources remains secure. According to recent data, around 70% of organizations in the region have implemented or are planning to implement cloud-based solutions to facilitate remote work. Consequently, cloud access-security-brokers are becoming essential in managing access controls and ensuring compliance with security policies, thereby propelling market expansion.

Rising Cybersecurity Threats

The cloud access-security-broker market is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. Organizations in the GCC are recognizing the necessity of robust security measures to protect sensitive data stored in cloud environments. As cyberattacks evolve, the need for advanced security solutions becomes paramount. In 2025, it is estimated that cybersecurity spending in the region will reach approximately $20 billion, reflecting a growing commitment to safeguarding digital assets. This trend underscores the critical role of cloud access-security-brokers in providing comprehensive security frameworks that can adapt to emerging threats, thereby driving market growth.

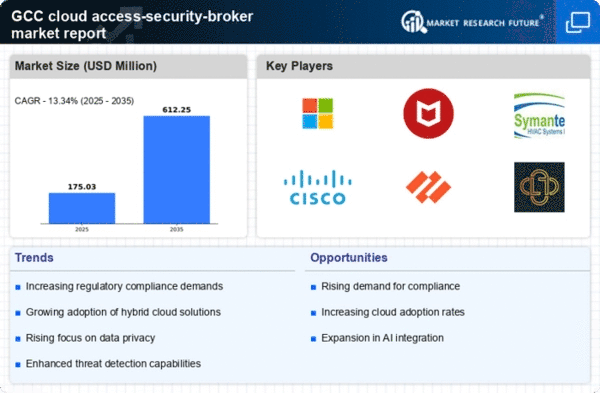

Demand for Compliance Solutions

The cloud access-security-broker market is increasingly driven by the need for compliance with various regulatory frameworks, such as GDPR and local data protection laws. Organizations in the GCC are under pressure to adhere to stringent data protection laws, which necessitate the implementation of effective security measures. The market for compliance solutions is expected to grow by 15% annually, as businesses seek to avoid penalties and protect their reputations. Cloud access-security-brokers play a vital role in helping organizations navigate these complex regulatory landscapes by providing tools and services that ensure compliance, thus fostering market growth.

Emergence of Hybrid Cloud Environments

The cloud access-security-broker market is witnessing growth due to the rise of hybrid cloud environments. Many organizations in the GCC are adopting hybrid models to leverage the benefits of both public and private clouds. This trend creates a complex security landscape, as businesses must ensure consistent security policies across diverse environments. It is estimated that by 2025, hybrid cloud adoption will account for over 60% of cloud deployments in the region. Cloud access-security-brokers are essential in this context, offering solutions that facilitate seamless integration and security across hybrid infrastructures, thereby driving market demand.

Increased Cloud Adoption by Enterprises

The cloud access-security-broker market is benefiting from the rapid adoption of cloud technologies by enterprises across the GCC. As organizations migrate their operations to the cloud, the demand for security solutions that can effectively manage and protect cloud environments is growing. Reports indicate that cloud adoption rates in the GCC are projected to reach 90% by 2026, highlighting a significant shift in how businesses operate. This trend creates a fertile ground for cloud access-security-brokers, which provide critical services such as data encryption, identity management, and threat detection, thereby driving market growth.