Increased Cloud Adoption

The rapid adoption of cloud computing technologies in South Korea is a key driver for the cloud access-security-broker market. As businesses migrate to cloud platforms, the need for effective security solutions becomes paramount. According to recent data, approximately 80% of South Korean enterprises are expected to utilize cloud services by the end of 2025. This shift necessitates the implementation of cloud access-security-broker solutions to ensure data integrity and compliance with local regulations. The growing reliance on cloud infrastructure creates a fertile ground for security providers, as organizations seek to protect their assets from potential vulnerabilities. Consequently, the cloud access-security-broker market is likely to witness substantial growth, driven by the increasing demand for secure cloud environments.

Rising Cybersecurity Threats

The cloud access-security-broker market in South Korea is experiencing growth due to the increasing frequency and sophistication of cyber threats. Organizations are compelled to adopt robust security measures to protect sensitive data stored in the cloud. In 2025, it is estimated that cybercrime could cost the global economy over $10 trillion annually, prompting South Korean businesses to invest in cloud access security solutions. This trend indicates a heightened awareness of the need for comprehensive security frameworks, which are essential for safeguarding cloud environments. As a result, the demand for cloud access-security-broker services is likely to surge, as companies seek to mitigate risks associated with data breaches and unauthorized access. The market is thus positioned for significant expansion as organizations prioritize cybersecurity in their digital transformation strategies.

Regulatory Landscape Evolution

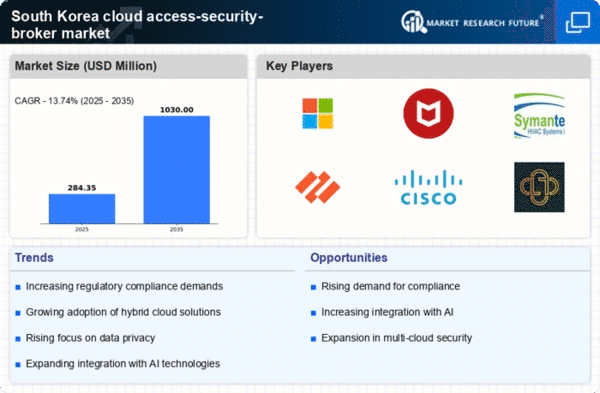

The evolving regulatory landscape in South Korea significantly impacts the cloud access-security-broker market. With the introduction of stricter data protection laws, organizations are required to enhance their security measures to comply with legal standards. The Personal Information Protection Act (PIPA) mandates that businesses implement adequate security protocols to safeguard personal data. This regulatory pressure is driving the adoption of cloud access-security-broker solutions, as companies strive to meet compliance requirements. In 2025, it is anticipated that the market for cloud access-security-broker services will expand as organizations invest in technologies that facilitate adherence to these regulations. The need for compliance not only enhances security but also fosters consumer trust, further propelling market growth.

Integration of AI and Automation

The integration of artificial intelligence (AI) and automation technologies into security frameworks is emerging as a crucial driver for the cloud access-security-broker market. In South Korea, organizations are increasingly leveraging AI to enhance their security posture and streamline operations. By automating threat detection and response processes, businesses can significantly reduce the time required to address security incidents. This trend is expected to gain momentum in 2025, as more companies recognize the efficiency and effectiveness of AI-driven security solutions. The cloud access-security-broker market stands to benefit from this technological advancement, as organizations seek to implement sophisticated security measures that can adapt to evolving threats. The potential for AI to transform security operations is likely to catalyze further investment in cloud access-security-broker services.

Demand for Data Privacy Solutions

In South Korea, the increasing emphasis on data privacy is a significant driver for the cloud access-security-broker market. As consumers become more aware of their data rights, businesses are compelled to adopt stringent privacy measures. The cloud access-security-broker market is positioned to benefit from this trend, as organizations seek solutions that ensure data protection and compliance with privacy regulations. In 2025, it is projected that the demand for data privacy solutions will continue to rise, leading to an increased reliance on cloud access-security-broker services. This shift reflects a broader societal trend towards prioritizing individual privacy, which in turn influences corporate strategies and investments in security technologies.