Supportive Government Policies

Supportive government policies in the GCC region are fostering the growth of the digital wound-measurement-devices market. Regulatory bodies are increasingly recognizing the need for advanced medical technologies to improve healthcare outcomes. Initiatives aimed at enhancing healthcare quality and accessibility are being implemented, which include the promotion of innovative medical devices. For instance, the GCC governments are working towards establishing regulatory frameworks that facilitate the approval and adoption of digital health technologies. This supportive environment is likely to encourage manufacturers to invest in the development of digital wound-measurement devices, thereby driving market growth.

Growing Awareness of Wound Care

There is a growing awareness of the importance of effective wound care among both healthcare professionals and patients in the GCC region. Educational initiatives and campaigns aimed at promoting best practices in wound management are becoming more prevalent. This heightened awareness is leading to an increased demand for digital wound-measurement devices, as they provide precise and reliable measurements that facilitate better treatment decisions. As healthcare providers recognize the benefits of using these devices in clinical settings, the digital wound-measurement-devices market is likely to expand, reflecting a shift towards evidence-based wound care.

Increased Healthcare Expenditure

Healthcare expenditure in the GCC region is on the rise, which is positively impacting the digital wound-measurement-devices market. Governments are investing heavily in healthcare infrastructure and services, with spending expected to reach $100 billion by 2025. This increase in funding allows for the procurement of advanced medical devices, including digital wound-measurement tools. As healthcare facilities upgrade their equipment to meet modern standards, the demand for these devices is likely to escalate. Furthermore, the emphasis on improving patient care and outcomes drives healthcare providers to adopt innovative solutions, thereby fostering market growth.

Technological Integration in Healthcare

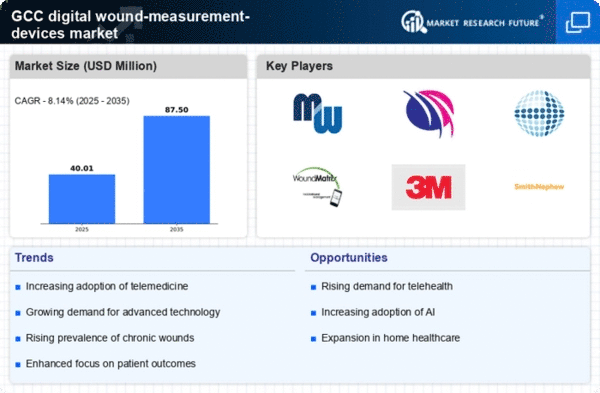

The integration of advanced technologies in healthcare is a pivotal driver for the digital wound-measurement-devices market. Innovations such as artificial intelligence, machine learning, and telemedicine are transforming wound care practices. These technologies enable healthcare professionals to monitor wounds remotely, analyze healing patterns, and make data-driven decisions. The GCC region is witnessing a surge in digital health initiatives, with investments in health tech projected to reach $2 billion by 2025. This technological evolution not only enhances the accuracy of wound measurements but also streamlines workflows, making it an attractive option for healthcare facilities. Consequently, the market for digital wound-measurement devices is poised for significant growth.

Rising Incidence of Wound-Related Conditions

The digital wound-measurement-devices market is experiencing growth due to the increasing prevalence of wound-related conditions in the GCC region. Factors such as diabetes, obesity, and an aging population contribute to a higher incidence of chronic wounds. According to recent health statistics, the prevalence of diabetes in the GCC is estimated to be around 16.8%, which significantly raises the risk of developing diabetic ulcers. This trend necessitates advanced wound management solutions, thereby driving demand for digital wound-measurement devices. As healthcare providers seek to improve patient outcomes and reduce treatment costs, the adoption of these devices is likely to increase, indicating a robust market potential.