Growing Awareness of Wound Care

There is a notable increase in awareness regarding wound care among healthcare professionals and patients in Japan. Educational initiatives and training programs are being implemented to emphasize the importance of proper wound management. This heightened awareness is driving the adoption of digital wound-measurement devices, as they provide accurate and efficient solutions for monitoring wound healing. The digital wound-measurement-devices market is likely to benefit from this trend, as healthcare providers recognize the value of utilizing technology to enhance patient care. As more practitioners become educated about the advantages of these devices, the market is expected to expand, reflecting a shift towards evidence-based wound management.

Increased Healthcare Expenditure

Japan's healthcare expenditure has been steadily increasing, which serves as a significant driver for the digital wound-measurement-devices market. The government allocates substantial resources to improve healthcare infrastructure and services, with a focus on innovative medical technologies. In 2025, healthcare spending is expected to reach approximately ¥50 trillion, indicating a strong commitment to enhancing patient care. This financial support enables healthcare facilities to invest in advanced wound care solutions, including digital measurement devices. As hospitals and clinics seek to optimize their resources and improve patient outcomes, the demand for these devices is likely to rise, further stimulating market growth.

Supportive Regulatory Environment

The regulatory environment in Japan is becoming increasingly supportive of innovative medical technologies, including digital wound-measurement devices. The Pharmaceuticals and Medical Devices Agency (PMDA) has streamlined the approval process for new medical devices, facilitating quicker access to market for advanced wound care solutions. This supportive framework encourages manufacturers to invest in research and development, leading to the introduction of cutting-edge products. As a result, the digital wound-measurement-devices market is poised for growth, as healthcare providers gain access to a wider range of effective tools for wound management. The favorable regulatory landscape is likely to enhance competition and innovation within the market.

Rising Incidence of Chronic Wounds

The increasing prevalence of chronic wounds in Japan is a critical driver for the digital wound-measurement-devices market. Factors such as an aging population and the rise in lifestyle-related diseases contribute to this trend. According to recent statistics, approximately 1.5 million individuals in Japan suffer from chronic wounds, necessitating advanced wound care solutions. Digital wound-measurement devices offer precise measurements and monitoring capabilities, which are essential for effective treatment. This growing patient population is likely to drive demand for innovative technologies that enhance wound management, thereby propelling the market forward. As healthcare providers seek to improve patient outcomes, the integration of digital solutions in wound care becomes increasingly vital.

Technological Integration in Healthcare

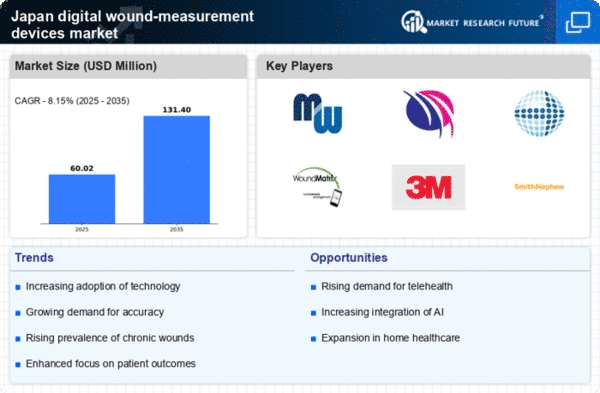

The integration of advanced technologies in healthcare is significantly influencing the digital wound-measurement-devices market. In Japan, the adoption of digital health solutions, including telemedicine and remote monitoring, is on the rise. This trend is supported by government initiatives aimed at enhancing healthcare efficiency and accessibility. The digital wound-measurement devices market is expected to benefit from this technological shift, as these devices provide real-time data and analytics that facilitate better clinical decision-making. Furthermore, the market is projected to grow at a CAGR of around 8% over the next five years, reflecting the increasing reliance on technology in wound care management.