Focus on Employee Well-being

The employee monitoring market is increasingly aligning with the focus on employee well-being in the GCC. Organizations are recognizing that monitoring solutions can play a crucial role in promoting a healthy work-life balance. By utilizing monitoring tools, companies can identify signs of employee burnout and stress, enabling them to implement supportive measures. This trend is supported by research indicating that organizations prioritizing employee well-being experience higher retention rates and productivity levels. As a result, the employee monitoring-solution market is likely to see growth as businesses seek to integrate well-being initiatives with monitoring practices, fostering a more engaged and satisfied workforce.

Increased Regulatory Scrutiny

The employee monitoring-solution market is influenced by the growing regulatory scrutiny surrounding workplace practices in the GCC. Governments are implementing stricter labor laws and regulations aimed at protecting employee rights and ensuring fair treatment. This regulatory environment compels organizations to adopt monitoring solutions that comply with legal standards while maintaining transparency. For instance, the introduction of data protection laws necessitates that companies implement systems that safeguard employee information. As a result, businesses are increasingly turning to employee monitoring solutions that not only enhance compliance but also foster a culture of trust and accountability. This trend is expected to drive the demand for sophisticated monitoring tools that align with regulatory requirements.

Shift Towards Hybrid Work Models

The employee monitoring market is adapting to the shift towards hybrid work models, which have become prevalent in the GCC. As organizations embrace flexible work arrangements, the need for effective monitoring solutions has intensified. Companies are seeking tools that can seamlessly track employee performance, regardless of their physical location. This shift is reflected in the increasing adoption of cloud-based monitoring solutions, which allow for real-time data access and analysis. The market is projected to grow as businesses recognize the importance of maintaining productivity and engagement in a hybrid work environment. The employee monitoring-solution market is likely to benefit from this trend, as organizations invest in technologies that facilitate remote oversight and collaboration.

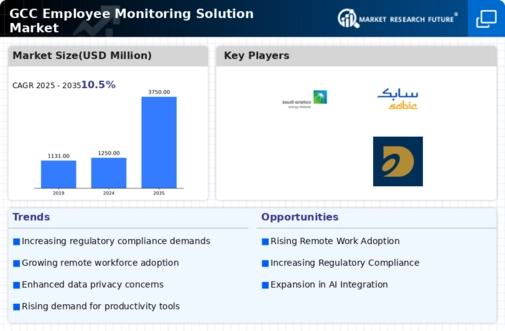

Rising Demand for Productivity Tools

The employee monitoring market is experiencing a notable surge in demand for productivity-enhancing tools. Organizations in the GCC are increasingly recognizing the need to optimize employee performance and ensure accountability. This trend is driven by the desire to improve operational efficiency and reduce costs. According to recent data, the market for productivity software in the GCC is projected to grow at a CAGR of 12% over the next five years. Companies are investing in monitoring solutions to track employee activities, manage workloads, and identify areas for improvement. This heightened focus on productivity is likely to propel the growth of the employee monitoring-solution market, as businesses seek to leverage technology to enhance workforce effectiveness.

Technological Advancements in Monitoring Solutions

The employee monitoring market is being propelled by rapid technological advancements that enhance the capabilities of monitoring tools. Innovations such as artificial intelligence, machine learning, and data analytics are transforming how organizations track employee performance and behavior. These technologies enable more accurate assessments and provide actionable insights, allowing companies to make informed decisions. The GCC region is witnessing a rise in the adoption of advanced monitoring solutions that leverage these technologies, leading to improved efficiency and effectiveness. As organizations seek to stay competitive, the employee monitoring-solution market is expected to expand, driven by the demand for cutting-edge tools that offer comprehensive monitoring capabilities.