Shift Towards Hybrid Work Models

The transition to hybrid work models is influencing the employee monitoring-solution market in India. As organizations adopt flexible work arrangements, the need for effective monitoring solutions becomes more pronounced. Companies are seeking tools that can provide visibility into employee performance, regardless of their physical location. This shift is prompting businesses to invest in monitoring solutions that can seamlessly integrate with various work environments. The employee monitoring-solution market is likely to benefit from this trend, as organizations prioritize tools that support both in-office and remote work. This adaptability is essential for maintaining productivity and ensuring that employees remain engaged and accountable.

Regulatory Compliance and Governance

In the context of the employee monitoring-solution market, regulatory compliance is emerging as a critical driver. Indian companies are increasingly subject to stringent regulations regarding data protection and employee rights. The implementation of monitoring solutions is often seen as a means to ensure compliance with these regulations, thereby mitigating legal risks. For instance, the Personal Data Protection Bill is expected to influence how organizations manage employee data. Companies that adopt monitoring solutions can demonstrate their commitment to governance and ethical practices, which may enhance their reputation and trustworthiness. This focus on compliance is likely to propel the growth of the employee monitoring-solution market as businesses seek to navigate the complex regulatory landscape.

Rising Demand for Productivity Tools

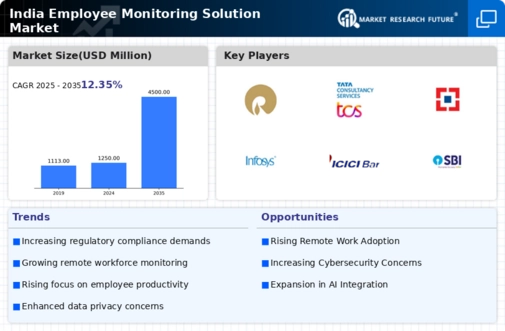

The employee monitoring-solution market in India is experiencing a notable surge in demand for productivity-enhancing tools. Organizations are increasingly recognizing the need to optimize employee performance and ensure accountability. This trend is driven by the competitive landscape, where companies strive to maximize output while minimizing costs. According to recent data, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of a broader shift towards data-driven decision-making, where businesses leverage monitoring solutions to gain insights into employee activities. As a result, the employee monitoring-solution market is becoming an essential component of organizational strategy, enabling firms to align workforce efforts with business objectives.

Increased Focus on Employee Well-being

The employee monitoring-solution market is also being driven by a growing emphasis on employee well-being. Organizations are recognizing that monitoring solutions can be utilized not only for productivity tracking but also for enhancing employee satisfaction and mental health. By analyzing work patterns and identifying potential burnout indicators, companies can take proactive measures to support their workforce. This holistic approach to monitoring is gaining traction, as businesses aim to create a positive work environment. Consequently, the employee monitoring-solution market is evolving to include features that prioritize employee well-being, which may lead to improved retention rates and overall organizational performance.

Technological Advancements in Monitoring Solutions

Technological innovation plays a pivotal role in shaping the employee monitoring-solution market. The advent of advanced software and hardware technologies has enabled organizations to implement more sophisticated monitoring systems. Features such as real-time analytics, AI-driven insights, and user-friendly interfaces are becoming standard in monitoring solutions. This evolution is not only enhancing the effectiveness of monitoring but also making it more accessible to a wider range of businesses. As organizations in India increasingly adopt these technologies, the employee monitoring-solution market is expected to expand significantly. The integration of cloud-based solutions is also facilitating remote access and management, further driving market growth.