Increasing Health Awareness

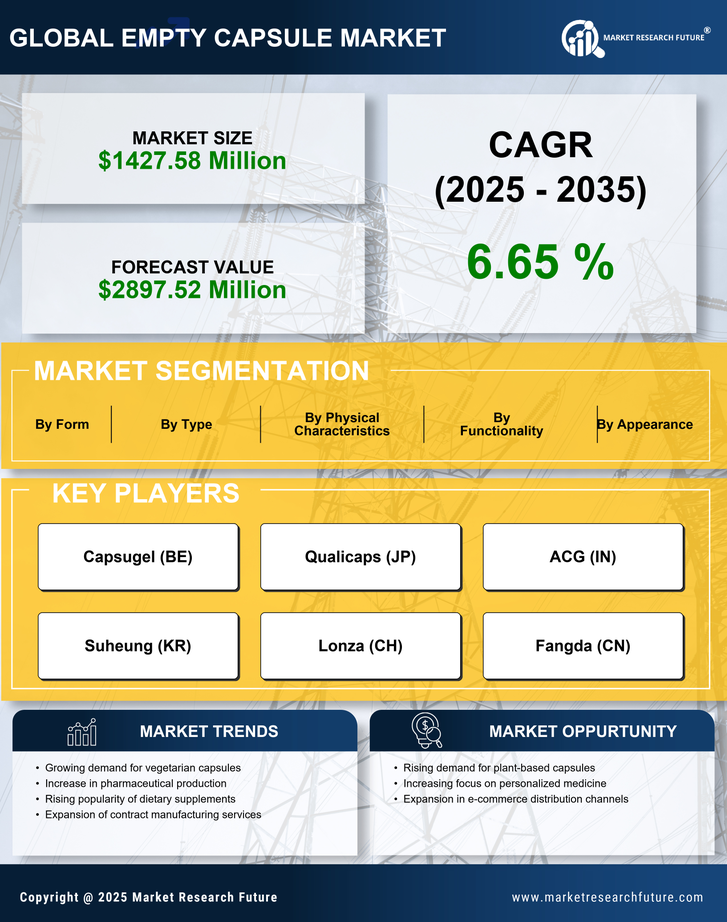

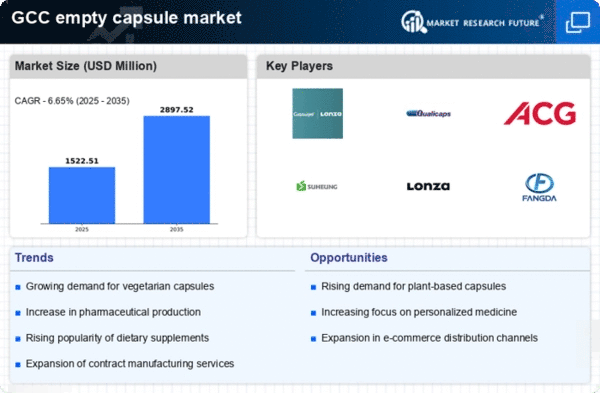

The empty capsule market in the GCC is experiencing growth driven by a rising awareness of health and wellness among consumers. As individuals become more conscious of their dietary choices, there is a notable shift towards dietary supplements and nutraceuticals. This trend is reflected in the increasing demand for empty capsules, which serve as a convenient delivery method for vitamins, minerals, and herbal supplements. Market data indicates that the GCC dietary supplement market is projected to grow at a CAGR of approximately 8% from 2025 to 2030, further fueling the empty capsule market. The growing preference for natural and organic products also contributes to this trend, as consumers seek out clean-label options that align with their health goals.

Expansion of Pharmaceutical Sector

The empty capsule market is significantly influenced by the expansion of the pharmaceutical sector within the GCC. With a focus on enhancing healthcare services and increasing access to medications, the region has seen a surge in pharmaceutical manufacturing. This growth is likely to drive demand for empty capsules, which are essential for encapsulating various pharmaceutical formulations. According to recent data, the GCC pharmaceutical market is expected to reach $40 billion by 2026, indicating a robust growth trajectory. As pharmaceutical companies seek to innovate and develop new drug delivery systems, the empty capsule market is poised to benefit from this expansion, providing a vital component in the production of capsules for both prescription and over-the-counter medications.

Growing E-commerce and Online Retail Channels

The empty capsule market is experiencing a transformation due to the rise of e-commerce and online retail channels. As consumers increasingly turn to online platforms for purchasing health and wellness products, the demand for empty capsules is expected to rise. E-commerce provides convenience and accessibility, allowing consumers to explore a wider range of products, including specialized and niche offerings. Data indicates that online sales of dietary supplements in the GCC are projected to grow by over 15% annually, further driving the empty capsule market. This shift in consumer behavior presents opportunities for manufacturers and retailers to enhance their online presence and cater to the evolving preferences of health-conscious consumers.

Rising Popularity of Vegan and Vegetarian Products

The empty capsule market is witnessing a shift towards vegan and vegetarian products, driven by changing consumer preferences. As more individuals adopt plant-based diets, there is an increasing demand for vegetarian capsules made from materials such as hydroxypropyl methylcellulose (HPMC). This trend is particularly pronounced in the GCC, where health-conscious consumers are seeking alternatives to traditional gelatin capsules. Market Research Future suggests that the vegetarian capsule segment is expected to grow at a CAGR of around 10% over the next five years. This shift not only reflects a broader trend towards sustainable and ethical consumption but also presents opportunities for manufacturers to innovate and cater to this growing segment of the market.

Technological Innovations in Capsule Manufacturing

The empty capsule market is benefiting from technological innovations in capsule manufacturing processes. Advances in production techniques, such as the development of non-gelatin capsules and improvements in encapsulation technology, are enhancing the efficiency and quality of capsule production. These innovations allow for greater customization and the ability to encapsulate a wider range of substances, including those sensitive to heat and moisture. As a result, manufacturers are better equipped to meet the diverse needs of the pharmaceutical and dietary supplement sectors. The introduction of automated production lines is also streamlining operations, potentially reducing costs and increasing output. This technological progress is likely to play a crucial role in shaping the future of the empty capsule market.