Aging Population and Rising Chronic Diseases

The aging population in the GCC is contributing to an increase in chronic diseases, which is a key driver for the endoscopic retrograde-cholangiopancreatography market. As individuals age, the prevalence of gastrointestinal disorders tends to rise, necessitating more diagnostic and therapeutic interventions. The demographic shift is expected to lead to a higher demand for endoscopic procedures, with projections indicating a potential market growth of 10% in the coming years. This trend underscores the importance of addressing the healthcare needs of an aging population, positioning the endoscopic retrograde-cholangiopancreatography market for sustained growth as healthcare systems adapt to these demographic changes.

Growing Awareness of Gastrointestinal Health

There is a marked increase in awareness regarding gastrointestinal health among the population in the GCC. Educational campaigns and health initiatives are promoting the importance of early diagnosis and treatment of gastrointestinal disorders. This heightened awareness is driving more patients to seek diagnostic procedures, including endoscopic retrograde-cholangiopancreatography. As a result, the market is witnessing a surge in demand, with estimates suggesting a growth rate of around 7% annually. The endoscopic retrograde-cholangiopancreatography market is likely to capitalize on this trend, as more individuals recognize the benefits of early intervention in managing gastrointestinal conditions.

Rising Demand for Minimally Invasive Procedures

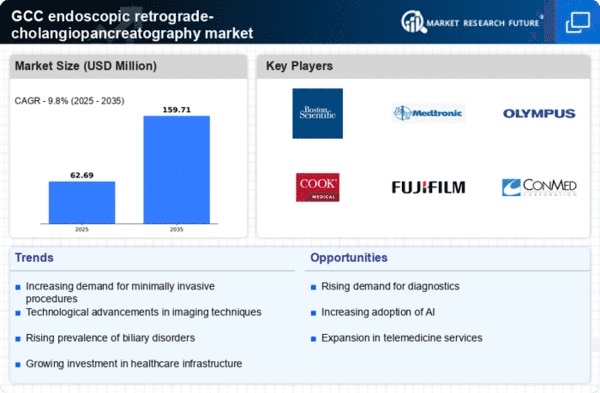

The endoscopic retrograde-cholangiopancreatography market is experiencing a notable increase in demand for minimally invasive procedures. Patients and healthcare providers are increasingly favoring techniques that reduce recovery time and minimize surgical risks. This trend is particularly pronounced in the GCC region, where healthcare systems are evolving to adopt advanced technologies. The market for minimally invasive procedures is projected to grow at a CAGR of approximately 8% over the next five years, indicating a robust shift towards endoscopic techniques. As a result, the endoscopic retrograde-cholangiopancreatography market is likely to benefit from this growing preference, as it aligns with the broader trend of enhancing patient outcomes while reducing hospital stays.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure across the GCC is a significant driver for the endoscopic retrograde-cholangiopancreatography market. Governments in the region are allocating substantial budgets to enhance healthcare facilities, which includes the procurement of advanced medical equipment. For instance, the healthcare expenditure in GCC countries is expected to reach $100 billion by 2026, reflecting a commitment to improving healthcare services. This influx of capital is likely to facilitate the adoption of endoscopic retrograde-cholangiopancreatography technologies, as hospitals upgrade their capabilities to provide comprehensive gastrointestinal care. Consequently, the market is poised for growth as healthcare providers expand their service offerings.

Technological Innovations in Endoscopic Equipment

Technological innovations in endoscopic equipment are significantly influencing the endoscopic retrograde-cholangiopancreatography market. The introduction of advanced imaging technologies, such as high-definition endoscopes and digital imaging systems, enhances the accuracy and effectiveness of procedures. These innovations are expected to improve patient outcomes and reduce complications, thereby increasing the adoption of endoscopic retrograde-cholangiopancreatography. The market is projected to grow as healthcare providers invest in state-of-the-art equipment, with a potential increase in market size by 15% over the next few years. This trend indicates a strong correlation between technological advancements and the expansion of the endoscopic retrograde-cholangiopancreatography market.