Growth of Big Data Technologies

the enterprise data management market is growing significantly due to the proliferation of big data technologies. Organizations in the GCC are increasingly generating vast amounts of data, necessitating advanced data management solutions to handle this influx. The integration of big data analytics tools is expected to enhance data processing capabilities, enabling businesses to extract valuable insights from complex datasets. This trend is likely to contribute to the expansion of the enterprise data-management market, as companies seek to leverage big data for improved decision making and operational efficiency. The demand for scalable and flexible data management solutions is anticipated to rise, prompting vendors to innovate and adapt their offerings to meet evolving market needs.

Increased Focus on Data Integration

the enterprise data management market is seeing a greater emphasis on data integration as organizations aim to create a unified view of their data assets. In the GCC region, businesses are recognizing the importance of integrating disparate data sources to enhance data accessibility and usability. This trend is driving the demand for data integration tools and platforms, which are essential for streamlining data workflows and improving collaboration across departments. As organizations aim to break down data silos, the enterprise data-management market is expected to benefit from the growing need for seamless data integration solutions. This focus on integration is likely to enhance overall data quality and support informed decision making across various business functions.

Emergence of Data-Driven Decision Making

the enterprise data management market is undergoing a shift towards data-driven decision making. Organizations in the GCC are increasingly leveraging data analytics to enhance operational efficiency and drive strategic initiatives. This trend is reflected in the growing adoption of business intelligence tools, which are projected to capture a significant share of the enterprise data-management market. By utilizing data insights, companies can optimize resource allocation, improve customer experiences, and identify new revenue streams. The emphasis on data-driven strategies is likely to propel the enterprise data-management market forward, as businesses seek to harness the power of data to gain a competitive edge in their respective industries.

Regulatory Compliance and Data Management

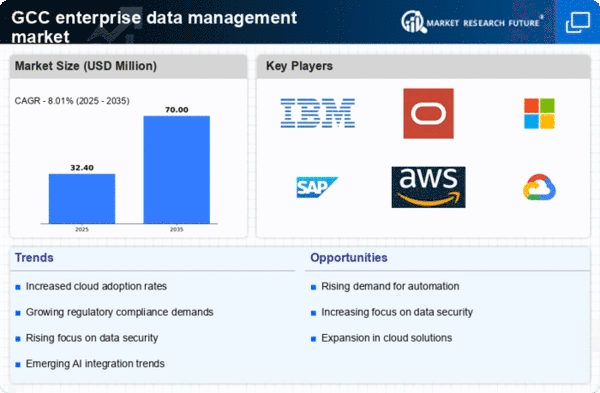

the enterprise data management market is greatly affected by the need for regulatory compliance. In the GCC region, organizations are increasingly required to adhere to various data protection laws and industry standards. This regulatory landscape compels businesses to invest in comprehensive data management solutions that ensure compliance with legal requirements. As a result, the market for enterprise data-management solutions is projected to expand, with compliance-related features becoming a key differentiator among vendors. Companies are focusing on implementing data governance frameworks and audit trails to demonstrate compliance, thereby enhancing their credibility and trustworthiness in the eyes of customers and stakeholders.

Rising Demand for Data Security Solutions

the enterprise data management market is seeing a significant increase in demand for robust data security solutions. As organizations in the GCC region increasingly recognize the importance of safeguarding sensitive information, investments in security technologies are projected to rise. According to recent estimates, the data security segment within the enterprise data-management market is expected to grow by approximately 15% annually. This growth is driven by the need to comply with stringent regulations and protect against cyber threats. Companies are prioritizing data encryption, access controls, and threat detection systems to mitigate risks. Consequently, the focus on data security is reshaping the enterprise data-management market landscape, compelling vendors to innovate and offer comprehensive security features that align with evolving customer expectations.