Advancements in Bioinformatics

Advancements in bioinformatics are significantly shaping the gene expression-analysis market. The integration of sophisticated computational tools and algorithms is enhancing the ability to analyze complex genomic data. In the GCC region, the development of bioinformatics platforms is facilitating the interpretation of gene expression data, enabling researchers to derive meaningful insights. This technological evolution is likely to lead to more accurate and efficient analyses, thereby attracting more stakeholders to the market. As bioinformatics continues to evolve, it is expected to play a pivotal role in the advancement of personalized medicine and targeted therapies. The synergy between gene expression analysis and bioinformatics is fostering a more comprehensive understanding of genetic information, which is essential for the future of healthcare in the GCC.

Government Initiatives and Funding

Government initiatives in the GCC region are playing a crucial role in propelling the gene expression-analysis market forward. Various national health programs are being launched to promote research and development in genomics and biotechnology. For instance, substantial funding is being allocated to support academic institutions and research organizations focused on gene expression studies. This financial backing is expected to stimulate innovation and facilitate the establishment of advanced laboratories equipped with cutting-edge technologies. As a result, the market is likely to witness an influx of new products and services aimed at enhancing gene expression analysis capabilities. The commitment of governments to bolster healthcare infrastructure and research initiatives is indicative of a long-term strategy to position the GCC as a leader in the field of genomics.

Growing Interest in Genomic Research

The growing interest in genomic research is a key driver of the gene expression-analysis market. Academic institutions and private organizations in the GCC are increasingly investing in genomic studies to explore the complexities of gene regulation and expression. This trend is reflected in the establishment of research centers dedicated to genomics, which are equipped with state-of-the-art technologies for gene expression analysis. The market is likely to benefit from collaborations between academia and industry, leading to the development of innovative products and services. Furthermore, the rising number of clinical trials focusing on gene therapies is expected to create additional demand for gene expression analysis. As the field of genomics continues to expand, the gene expression-analysis market is poised for substantial growth, driven by the quest for new knowledge and therapeutic advancements.

Rising Demand for Precision Medicine

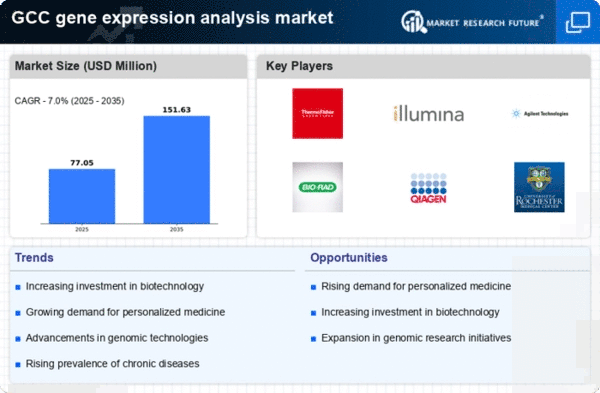

The gene expression-analysis market is experiencing a notable surge in demand driven by the increasing emphasis on precision medicine. As healthcare systems in the GCC region evolve, there is a growing recognition of the need for tailored therapeutic approaches. This shift is reflected in the rising investments in genomic research and the development of targeted therapies. The market is projected to grow at a CAGR of approximately 10% over the next five years, indicating a robust expansion. Healthcare providers are increasingly utilizing gene expression analysis to identify biomarkers that can guide treatment decisions, thereby enhancing patient outcomes. This trend underscores the critical role of gene expression analysis in the advancement of personalized healthcare solutions, positioning it as a pivotal component of the evolving medical landscape in the GCC.

Increasing Incidence of Genetic Disorders

The rising incidence of genetic disorders in the GCC region is significantly influencing the gene expression-analysis market. As awareness of genetic conditions grows, healthcare providers are increasingly turning to gene expression analysis as a diagnostic tool. This trend is particularly evident in the context of hereditary diseases, where early detection can lead to more effective management strategies. The market is projected to expand as healthcare systems integrate gene expression analysis into routine diagnostic protocols. Furthermore, the prevalence of conditions such as cancer and metabolic disorders is prompting research into the underlying genetic factors, thereby driving demand for advanced analytical techniques. The gene expression-analysis market is thus positioned to benefit from the urgent need for innovative solutions to address the challenges posed by genetic disorders.