Government Initiatives and Support

Government initiatives in the GCC region are playing a crucial role in shaping the healthcare crm market. Various national health strategies emphasize the importance of digital transformation in healthcare, which includes the adoption of CRM systems. For instance, initiatives aimed at improving healthcare infrastructure and promoting the use of technology in patient management are gaining momentum. The healthcare crm market is likely to benefit from these supportive policies, as they encourage healthcare providers to invest in advanced CRM solutions. Furthermore, funding and incentives provided by governments for digital health projects are expected to stimulate market growth. As a result, the healthcare crm market is poised for expansion, driven by these proactive government measures.

Growing Emphasis on Data Analytics

The increasing emphasis on data analytics within the healthcare crm market is transforming how healthcare organizations operate. In the GCC, healthcare providers are leveraging data analytics to gain insights into patient behavior, treatment outcomes, and operational efficiency. This trend is indicative of a broader movement towards data-driven decision-making in healthcare. The healthcare crm market is witnessing a surge in demand for analytics capabilities, as organizations seek to optimize their services and improve patient care. Reports suggest that the integration of advanced analytics into CRM systems could enhance patient engagement by up to 30%. Consequently, the focus on data analytics is likely to be a significant driver of growth in the healthcare crm market.

Increased Focus on Interoperability

Interoperability is becoming a critical factor in the healthcare crm market, particularly in the GCC region. As healthcare systems evolve, the need for seamless data exchange between various platforms and providers is paramount. This focus on interoperability is driven by the desire to improve care coordination and enhance patient outcomes. Healthcare organizations are increasingly seeking CRM solutions that can integrate with existing systems, enabling a holistic view of patient data. The healthcare crm market is expected to grow as organizations prioritize interoperability, which is essential for effective patient management. This trend may lead to a more connected healthcare ecosystem, ultimately benefiting both providers and patients.

Rising Demand for Patient-Centric Solutions

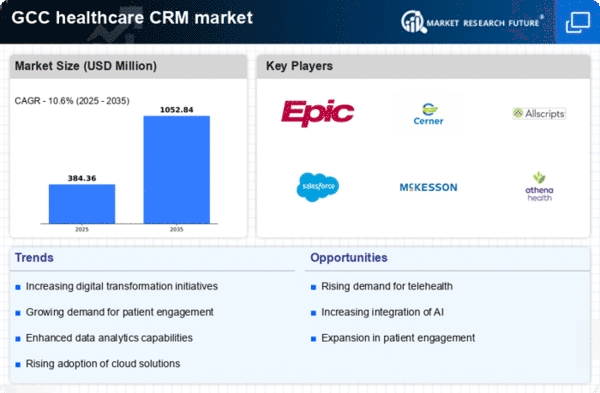

The healthcare crm market is experiencing a notable shift towards patient-centric solutions, driven by the increasing demand for personalized healthcare experiences. In the GCC region, healthcare providers are recognizing the importance of understanding patient needs and preferences. This trend is reflected in the growing investment in CRM systems that facilitate better patient engagement and communication. According to recent data, the healthcare crm market in the GCC is projected to grow at a CAGR of approximately 15% over the next five years. This growth is largely attributed to the need for enhanced patient satisfaction and loyalty, as healthcare organizations strive to improve their service delivery and outcomes. As a result, the focus on patient-centric solutions is likely to remain a key driver in the healthcare crm market.

Rising Competition Among Healthcare Providers

The competitive landscape among healthcare providers in the GCC is intensifying, which is influencing the healthcare crm market. As more players enter the market, there is a growing need for differentiation through enhanced patient services and engagement strategies. Healthcare organizations are increasingly adopting CRM systems to streamline operations and improve patient interactions. This competitive pressure is likely to drive innovation within the healthcare crm market, as providers seek to leverage technology to gain a competitive edge. Furthermore, the potential for increased market share through improved patient satisfaction is prompting organizations to invest in CRM solutions. As a result, the healthcare crm market is expected to witness robust growth fueled by this rising competition.