Rising Complexity of Regulations

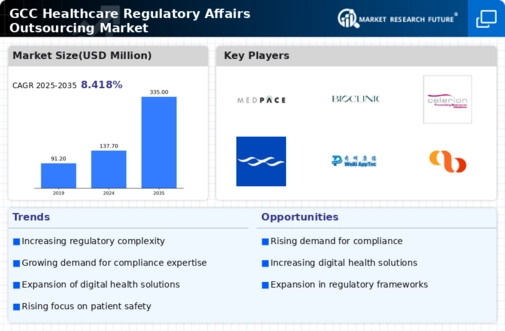

The healthcare regulatory-affairs-outsourcing market is experiencing a notable increase in the complexity of regulations across the GCC region. As governments implement more stringent compliance requirements, organizations are compelled to seek specialized outsourcing services to navigate these intricate frameworks. This complexity is driven by the need for enhanced patient safety and product efficacy, which in turn necessitates a deeper understanding of local and international regulations. The market for regulatory affairs outsourcing is projected to grow at a CAGR of approximately 12% over the next five years, reflecting the increasing reliance on external expertise to manage compliance effectively.

Expansion of Biopharmaceutical Sector

The biopharmaceutical sector is expanding rapidly in the GCC, driving demand for regulatory affairs outsourcing services. As more companies enter the market with novel therapies and biologics, the need for specialized regulatory expertise becomes paramount. This expansion is supported by government initiatives aimed at fostering innovation and attracting foreign investment in the healthcare sector. Consequently, the healthcare regulatory-affairs-outsourcing market is poised for growth, with estimates suggesting an increase in market size by over 15% in the next few years as biopharmaceutical companies seek to navigate the complex regulatory landscape.

Growing Focus on Patient-Centric Approaches

There is an increasing emphasis on patient-centric approaches within the healthcare regulatory-affairs-outsourcing market. Organizations are recognizing the importance of aligning their regulatory strategies with patient needs and preferences. This shift is prompting regulatory bodies to adopt more flexible frameworks that facilitate faster approvals for innovative therapies. As a result, outsourcing firms are adapting their services to support this trend, which may lead to a more collaborative environment between stakeholders. The market is likely to see a rise in demand for services that prioritize patient engagement, potentially influencing regulatory timelines and approval processes.

Increased Investment in Healthcare Infrastructure

The GCC region is witnessing a surge in investment in healthcare infrastructure, which is positively impacting the healthcare regulatory-affairs-outsourcing market. Governments are allocating substantial funds to enhance healthcare facilities and services, thereby creating a conducive environment for regulatory compliance. This investment is likely to lead to an increase in the number of clinical trials and product launches, necessitating robust regulatory support. As a result, outsourcing firms are expected to play a crucial role in assisting organizations with compliance and regulatory submissions, potentially leading to a market growth rate of around 10% in the coming years.

Technological Advancements in Regulatory Processes

Technological innovations are significantly transforming the healthcare regulatory-affairs-outsourcing market. The integration of advanced technologies such as artificial intelligence and machine learning is streamlining regulatory processes, enabling faster data analysis and improved decision-making. These advancements allow outsourcing firms to offer more efficient services, thereby attracting clients seeking to reduce time-to-market for their products. In the GCC, the adoption of such technologies is expected to enhance the overall efficiency of regulatory submissions, potentially reducing costs by up to 20% for companies that leverage these solutions.