Increasing Cardiovascular Diseases

The prevalence of cardiovascular diseases in the GCC region appears to be on the rise, which may drive the demand for anticoagulants, including heparin. According to health statistics, cardiovascular diseases account for a significant portion of mortality rates in the region. This trend suggests that healthcare providers are likely to increase their reliance on heparin market products to manage these conditions effectively. As the population ages and lifestyle-related health issues become more common, the heparin market may experience substantial growth. The increasing awareness of preventive healthcare measures could further bolster the demand for heparin, as it plays a crucial role in the management of thromboembolic disorders. Consequently, the heparin market is poised for expansion as healthcare systems adapt to these evolving health challenges.

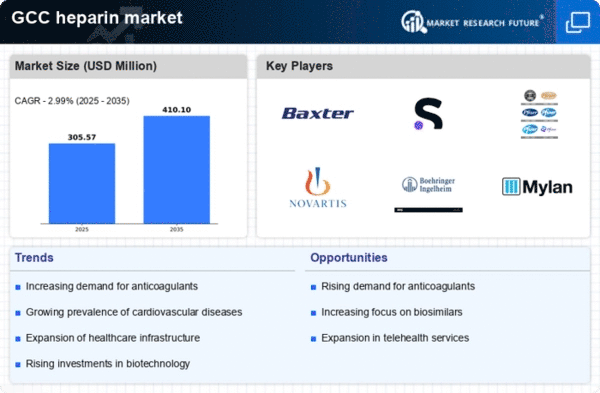

Expansion of Healthcare Infrastructure

The ongoing expansion of healthcare infrastructure in the GCC region is likely to create new opportunities for the heparin market. As governments invest in healthcare facilities and services, access to anticoagulant therapies, including heparin, may improve significantly. This expansion could lead to an increase in the number of healthcare providers offering heparin treatments, thereby driving demand. Additionally, the establishment of specialized clinics and hospitals focused on cardiovascular care may further enhance the visibility and availability of heparin products. As the healthcare landscape evolves, the heparin market may benefit from increased utilization and a broader patient base, suggesting a positive outlook for future growth.

Rising Awareness of Thrombosis Management

There appears to be a growing awareness among healthcare professionals and patients regarding the importance of thrombosis management in the GCC region. Educational initiatives and campaigns aimed at highlighting the risks associated with thromboembolic events may contribute to increased utilization of heparin. The heparin market could see a surge in demand as more healthcare providers recognize the critical role of anticoagulants in preventing complications. Additionally, the rising incidence of conditions such as deep vein thrombosis and pulmonary embolism may further drive the need for effective anticoagulation therapies. As awareness continues to grow, the heparin market may experience a corresponding increase in product adoption and usage.

Technological Advancements in Drug Delivery

Innovations in drug delivery systems are likely to enhance the efficacy and safety of heparin administration. The heparin market is witnessing a shift towards more sophisticated delivery mechanisms, such as pre-filled syringes and smart infusion pumps. These advancements may improve patient compliance and reduce the risk of dosing errors, which is critical in anticoagulant therapy. Furthermore, the integration of technology in healthcare, including telemedicine and remote monitoring, could facilitate better management of patients requiring heparin. As healthcare providers in the GCC increasingly adopt these technologies, the heparin market may benefit from a more streamlined approach to treatment. This trend indicates a potential for growth in the market as healthcare systems prioritize patient-centered care and safety.

Government Regulations and Quality Standards

The regulatory landscape surrounding pharmaceuticals in the GCC region is evolving, with governments implementing stricter quality standards for drug manufacturing and distribution. This trend may positively impact the heparin market by ensuring that only high-quality products are available to healthcare providers and patients. Compliance with these regulations could lead to increased trust in heparin products, potentially boosting market growth. Furthermore, as regulatory bodies emphasize safety and efficacy, manufacturers may be encouraged to invest in research and development, leading to the introduction of new heparin formulations. This focus on quality assurance may ultimately enhance the reputation of the heparin market and foster a more competitive environment.