Expansion of Automotive Sector

The automotive sector in the GCC is expanding rapidly, which significantly impacts the lead acid-battery market. With the increasing production of vehicles, particularly in the electric and hybrid segments, the demand for lead acid batteries is likely to rise. These batteries are widely used in conventional vehicles for starting, lighting, and ignition (SLI) applications. In 2025, it is estimated that the automotive segment will account for over 40% of the total lead acid-battery market share in the region. This growth is further supported by government initiatives aimed at promoting local manufacturing and reducing reliance on imports. As the automotive industry continues to evolve, the lead acid-battery market is expected to adapt and thrive, catering to the needs of this burgeoning sector.

Infrastructure Development Initiatives

Infrastructure development initiatives across the GCC are playing a crucial role in shaping the lead acid-battery market. Governments in the region are investing heavily in transportation, energy, and telecommunications infrastructure, which necessitates reliable power sources. Lead acid batteries are often employed in backup power systems for critical infrastructure, ensuring uninterrupted service. The market is likely to see a significant uptick in demand as these projects progress. In 2025, infrastructure-related applications are projected to contribute approximately 30% to the overall lead acid-battery market. This trend underscores the importance of lead acid batteries in supporting the region's ambitious infrastructure goals and enhancing energy security.

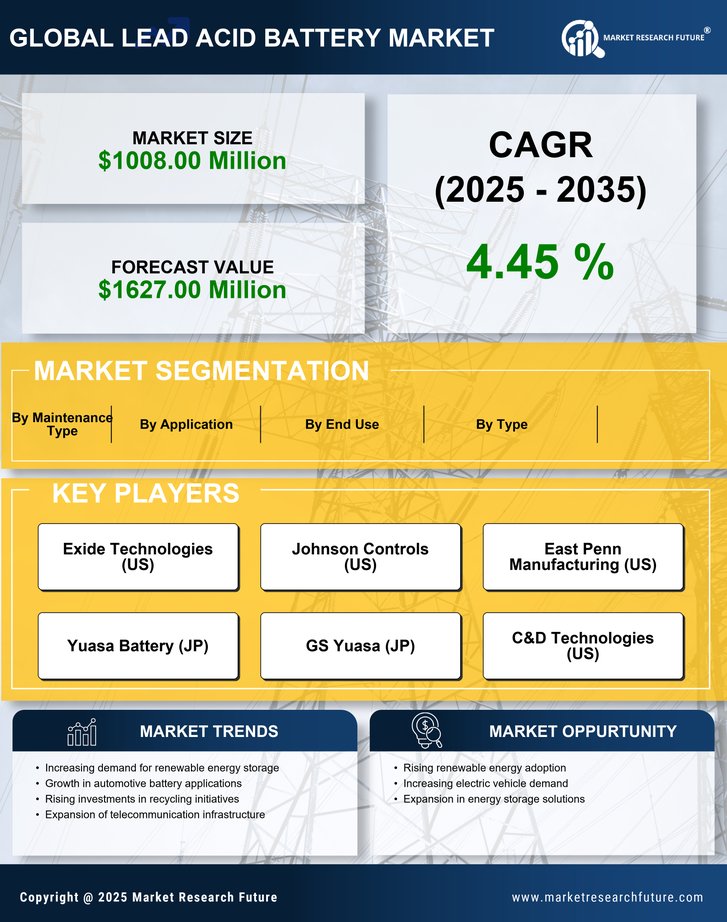

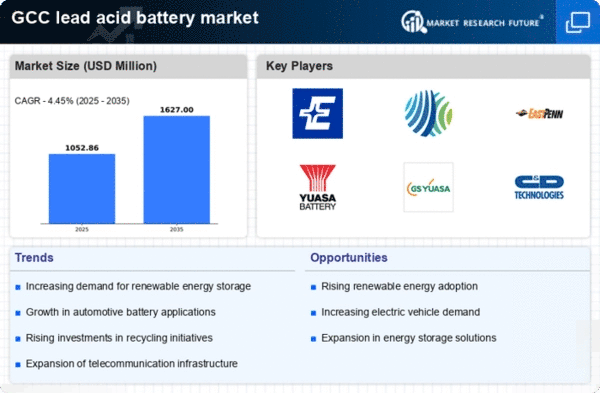

Rising Demand for Energy Storage Solutions

The lead acid-battery market is experiencing a notable increase in demand for energy storage solutions, particularly in the GCC region. This surge is primarily driven by the growing need for reliable power sources in various sectors, including telecommunications, renewable energy, and automotive. As the region invests heavily in renewable energy projects, the requirement for efficient energy storage systems becomes paramount. The lead acid-battery market is poised to benefit from this trend, as these batteries offer a cost-effective solution for energy storage. In 2025, the market is projected to reach a valuation of approximately $1.5 billion, reflecting a compound annual growth rate (CAGR) of around 5%. This growth indicates a robust demand for lead acid batteries as a viable energy storage option.

Increased Focus on Recycling and Sustainability

The lead acid-battery market is witnessing a growing emphasis on recycling and sustainability practices within the GCC. As environmental concerns gain traction, stakeholders are increasingly recognizing the importance of responsible battery disposal and recycling. Lead acid batteries are among the most recycled products globally, with a recycling rate exceeding 95%. This focus on sustainability not only helps mitigate environmental impact but also supports the circular economy. In 2025, the market is expected to see a rise in demand for recycled lead acid batteries, driven by both regulatory pressures and consumer preferences for eco-friendly products. This trend is likely to enhance the reputation of the lead acid-battery market as a sustainable choice in the energy storage landscape.

Technological Innovations in Battery Manufacturing

Technological innovations in battery manufacturing are significantly influencing the lead acid-battery market. Advances in production techniques and materials are enhancing the performance and lifespan of lead acid batteries, making them more competitive against alternative technologies. Innovations such as improved grid designs and advanced electrolyte formulations are contributing to higher efficiency and reduced maintenance requirements. As manufacturers adopt these technologies, the lead acid-battery market is likely to experience a boost in demand, particularly in sectors requiring reliable and long-lasting power solutions. By 2025, it is anticipated that these innovations will lead to a 15% increase in the overall efficiency of lead acid batteries, further solidifying their position in the energy storage market.