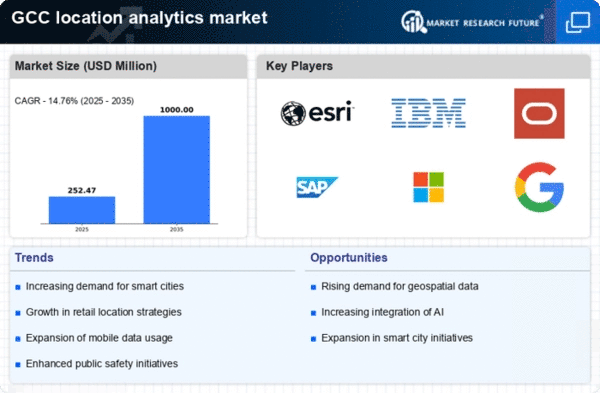

The location analytics market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for data-driven decision-making across various sectors. Key players are actively engaging in strategies that emphasize innovation, partnerships, and regional expansion to enhance their market presence. Companies such as Esri (US), IBM (US), and Microsoft (US) are at the forefront, leveraging their technological capabilities to provide advanced analytics solutions. Esri (US) focuses on geographic information systems (GIS) to empower organizations with spatial data insights, while IBM (US) emphasizes AI integration to enhance predictive analytics capabilities. Microsoft (US) is strategically positioning itself through its Azure cloud platform, facilitating seamless integration of location data into business operations, thereby shaping a competitive environment that prioritizes technological advancement and customer-centric solutions.

In terms of business tactics, companies are increasingly localizing their operations and optimizing supply chains to better serve regional markets. The competitive structure of the location analytics market appears moderately fragmented, with several players vying for market share. However, the collective influence of major companies like Oracle (US) and SAP (DE) is notable, as they continue to expand their offerings through strategic acquisitions and partnerships, thereby enhancing their capabilities and market reach.

In October 2025, Esri (US) announced a partnership with a leading telecommunications provider to integrate real-time location data into their network management systems. This strategic move is likely to enhance operational efficiency and improve service delivery, positioning Esri (US) as a key player in the telecommunications sector. The integration of location analytics into network management could potentially lead to significant cost savings and improved customer satisfaction, reflecting the growing importance of location intelligence in operational strategies.

In September 2025, IBM (US) launched a new suite of AI-driven location analytics tools aimed at retail businesses. This initiative is indicative of IBM's commitment to harnessing AI to provide actionable insights that can drive sales and enhance customer experiences. By focusing on the retail sector, IBM (US) is likely to capture a significant share of the market, as businesses increasingly seek to leverage data for competitive advantage.

In August 2025, Microsoft (US) expanded its Azure Maps capabilities, introducing enhanced geospatial analytics features. This development is crucial as it allows businesses to integrate location data more effectively into their operations, thereby improving decision-making processes. The expansion of Azure Maps signifies Microsoft's intent to solidify its position in the location analytics market, catering to the growing demand for integrated solutions that combine location intelligence with cloud computing.

As of November 2025, current trends in the location analytics market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances among key players are shaping the competitive landscape, fostering innovation and enhancing service offerings. The shift from price-based competition to a focus on technological differentiation and supply chain reliability is evident, suggesting that companies will need to continuously innovate to maintain a competitive edge. Looking ahead, the evolution of competitive differentiation will likely hinge on the ability to leverage advanced technologies and forge strategic partnerships that enhance operational capabilities.