Growing Focus on Data Analytics

The medical terminology-software market is witnessing a growing focus on data analytics, which is becoming increasingly vital for healthcare providers in the GCC. The ability to analyze large datasets allows for improved decision-making and enhanced patient outcomes. Medical terminology software that incorporates data analytics capabilities can help healthcare organizations identify trends, track patient progress, and optimize treatment plans. As healthcare systems evolve, the demand for software that can effectively manage and analyze medical data is likely to rise. Reports suggest that the healthcare analytics market in the GCC is expected to reach $1 billion by 2026, indicating a strong correlation with the growth of medical terminology software that supports data-driven insights.

Government Initiatives and Funding

Government initiatives in the GCC region are significantly influencing the medical terminology-software market. Various national health strategies emphasize the digitization of healthcare services, which includes the implementation of advanced medical terminology software. For instance, the Saudi Vision 2030 and the UAE's Health Strategy aim to enhance healthcare quality through technology. These initiatives often come with substantial funding, which is likely to bolster the development and adoption of medical terminology solutions. As a result, healthcare institutions are increasingly investing in software that ensures compliance with regulatory standards and improves communication among healthcare professionals. This trend suggests a robust growth trajectory for the medical terminology-software market, as public sector investments are expected to drive innovation and accessibility.

Technological Advancements in Healthcare

Technological advancements are reshaping the medical terminology-software market in the GCC. Innovations such as natural language processing and machine learning are enhancing the capabilities of medical terminology software, making it more efficient and user-friendly. These advancements enable healthcare professionals to quickly access and utilize medical terminology, thereby improving documentation accuracy and reducing administrative burdens. As technology continues to evolve, the integration of advanced features into medical terminology software is expected to become a key driver of market growth. The increasing reliance on technology in healthcare settings suggests that the medical terminology-software market will likely expand as providers seek to leverage these advancements for improved operational efficiency.

Increased Emphasis on Patient-Centric Care

The shift towards patient-centric care is significantly impacting the medical terminology-software market. Healthcare providers in the GCC are increasingly prioritizing patient engagement and satisfaction, which necessitates the use of software that accurately captures and utilizes medical terminology. This focus on personalized care requires systems that can effectively communicate patient information among various stakeholders, including doctors, nurses, and administrative staff. As a result, medical terminology software that enhances communication and ensures accurate documentation is becoming essential. The trend towards patient-centric models is likely to drive demand for innovative software solutions that facilitate better patient-provider interactions and improve overall healthcare delivery.

Rising Demand for Digital Health Solutions

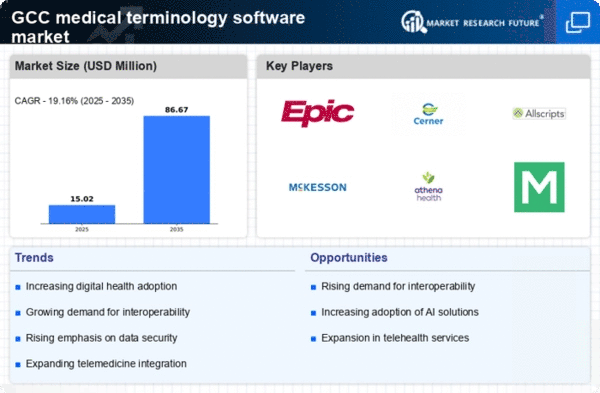

The medical terminology-software market is experiencing a notable surge in demand for digital health solutions across the GCC region. This trend is driven by the increasing need for efficient healthcare delivery systems that can manage vast amounts of medical data. As healthcare providers seek to enhance patient care and streamline operations, the adoption of software that facilitates accurate medical terminology becomes essential. Reports indicate that the GCC healthcare IT market is projected to grow at a CAGR of approximately 15% from 2025 to 2030, highlighting the potential for medical terminology software to play a pivotal role in this transformation. Furthermore, the integration of such software aids in reducing errors in medical documentation, thereby improving overall healthcare outcomes.