Increased Focus on Training and Education

The medical terminology-software market in Italy is witnessing an increased focus on training and education for healthcare professionals. As the complexity of medical terminology grows, there is a pressing need for effective training programs that equip users with the skills necessary to utilize software efficiently. Healthcare organizations are recognizing that investing in training not only enhances the proficiency of their staff but also maximizes the benefits of medical terminology software. This emphasis on education is likely to lead to higher adoption rates and improved outcomes in clinical documentation and coding practices. Consequently, the commitment to training and education serves as a vital driver for the medical terminology-software market in Italy.

Rising Demand for Digital Health Solutions

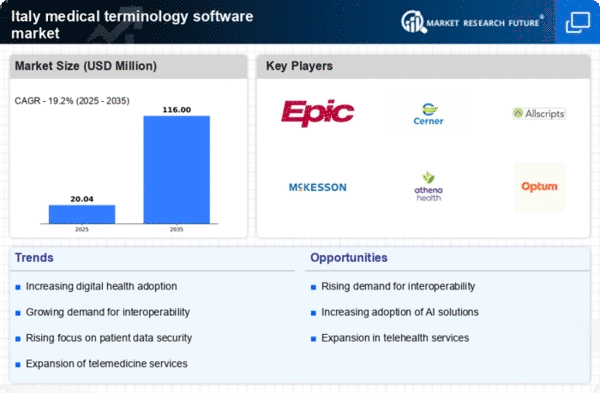

the medical terminology-software market in Italy is experiencing a significant increase in demand for digital health solutions. This trend is driven by the increasing adoption of electronic health records (EHRs) and telemedicine platforms, which necessitate accurate medical terminology for effective communication. According to recent data, the Italian digital health market is projected to grow at a CAGR of 15% from 2025 to 2030. As healthcare providers seek to enhance patient care and streamline operations, the need for sophisticated medical terminology software becomes paramount. This software not only aids in clinical documentation but also supports billing and coding processes, thereby improving overall efficiency in healthcare delivery. Consequently, the rising demand for digital health solutions is a significant driver for the medical terminology-software market in Italy.

Advancements in Natural Language Processing

Advancements in natural language processing (NLP) technology are significantly influencing the medical terminology-software market in Italy. NLP enables software to understand and interpret human language, facilitating more accurate coding and documentation in healthcare settings. As healthcare providers increasingly rely on automated solutions to enhance efficiency, the integration of NLP into medical terminology software is becoming essential. This technology allows for improved clinical decision support and enhances the accuracy of patient records. The growing interest in NLP applications within the healthcare sector suggests that the medical terminology-software market will continue to evolve, driven by the need for innovative solutions that streamline workflows and improve patient outcomes.

Growing Emphasis on Data Security and Privacy

Data security and privacy concerns are becoming increasingly prominent in the medical terminology-software market in Italy. With the rise of cyber threats and data breaches, healthcare organizations are prioritizing the protection of sensitive patient information. The implementation of stringent data protection regulations, such as the General Data Protection Regulation (GDPR), has heightened the need for software solutions that ensure compliance and safeguard patient data. As healthcare providers seek to mitigate risks associated with data handling, the demand for medical terminology software that incorporates robust security features is likely to increase. This focus on data security not only enhances trust among patients but also aligns with regulatory requirements, making it a critical driver for the medical terminology-software market in Italy.

Government Initiatives for Healthcare Digitization

In Italy, government initiatives aimed at digitizing healthcare services are playing a crucial role in propelling the medical terminology-software market. The Italian Ministry of Health has launched various programs to promote the use of digital tools in healthcare settings, which include funding for software development and training for healthcare professionals. These initiatives are designed to enhance the quality of care and ensure that healthcare providers are equipped with the necessary tools to manage patient information effectively. As a result, the medical terminology-software market is likely to benefit from increased investments and support from public institutions. The government's commitment to improving healthcare infrastructure is expected to drive the adoption of medical terminology software, thereby fostering growth in this sector.